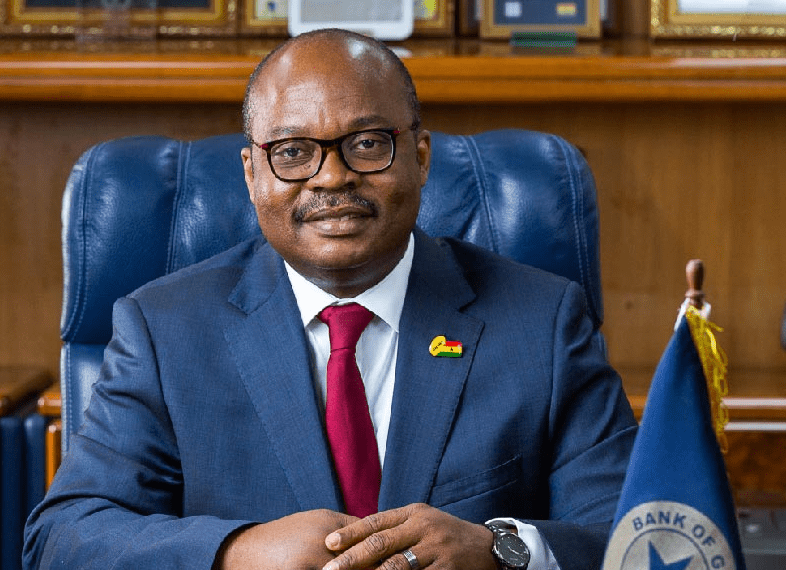

Dr Ernest Addison — Governor of BoG A centralised cyber security system has been set up by the Bank of Ghana (BoG) as part of its enhanced effort to deal with electronic fraud and cyber risks in the banking sector.

Known as the Financial Industry Command Security Operation Centre (FICSOC), the system is to be hooked up to the individual security information and events management (SIEM)/security operation centres (SOCs) of banks and other institutions to receive real-time reports and trigger actions, when necessary.

The Governor of the BoG, Dr Ernest Addison, said at a news conference last Monday that the system would help the BoG undertake real-time monitoring of transactions in all banks and other deposit-taking institutions.

Set up

The establishment of FICSOC was completed this year by Virtual Infosec Africa (VIA), an indigenous company, allowing banks and other institutions regulated by the BoG to start connecting their systems to it.

It is expected that the successful operationalisation of the centralised command centre would help reduce electronic fraud such as theft and duplication of automated teller machines (ATMs), which more than doubled last year.

First bank

To get the system started, the central bank has named the Agricultural Development Bank Limited (ADB) as the first institution to be connected to FICSOC to help check malpractices in electronic and financial technology transactions.

The ADB has thus become the first bank to be hooked up to the system after successfully setting up its SIEM/SOC earlier this year.

Dr Addison, who was answering a question on how the central bank was working to reduce electronic fraud in the financial sector, said FICSOC and the subsequent hooking up of the security centres of financial institutions were a sure way of fighting the canker.

“Our financial services are becoming more technology driven, and with technology, the risks associated with ATMs and point of sale (PoS) fraud also go up. Fortunately, we are looking closely at that,” he said during the press conference to announce the bank’s policy decision for the last quarter of the year.“We have what we call FICSOC, the security operating centre of the central bank, which monitors our cyber resilience real-time. Currently, we are in the midst of setting up the financial industry SIEM/SOC. I believe the BoG is ready and the ADB is getting connected to that FICSOC,” he said.Earlier this month, the National Intelligence Bureau (NIB) busted one Bachir Musa Aminou with 656 ATM […]