For the mining & metals industry, 2021 will be remembered for two very clear themes. First, the stunning recovery from the COVID-19 pandemic that sent commodity prices soaring to levels never seen before. Second, that ESG has anchored itself as a mainstream aspect of business and will remain top-of-mind in the boardroom.

While the industry proved itself remarkably resilient to the initial shock of the pandemic, 2021 highlighted that it was also well positioned to profit from the global recovery. As trillions of dollars of global stimulus fueled a rebound in both industrial and consumer demand, commodity prices surged. Copper, iron ore and lithium all hit records, alongside coal and natural gas. After years of streamlining businesses and being intensely disciplined in bringing on new supply, miners were able to deliver record profits and hand back bumper dividends to shareholders.

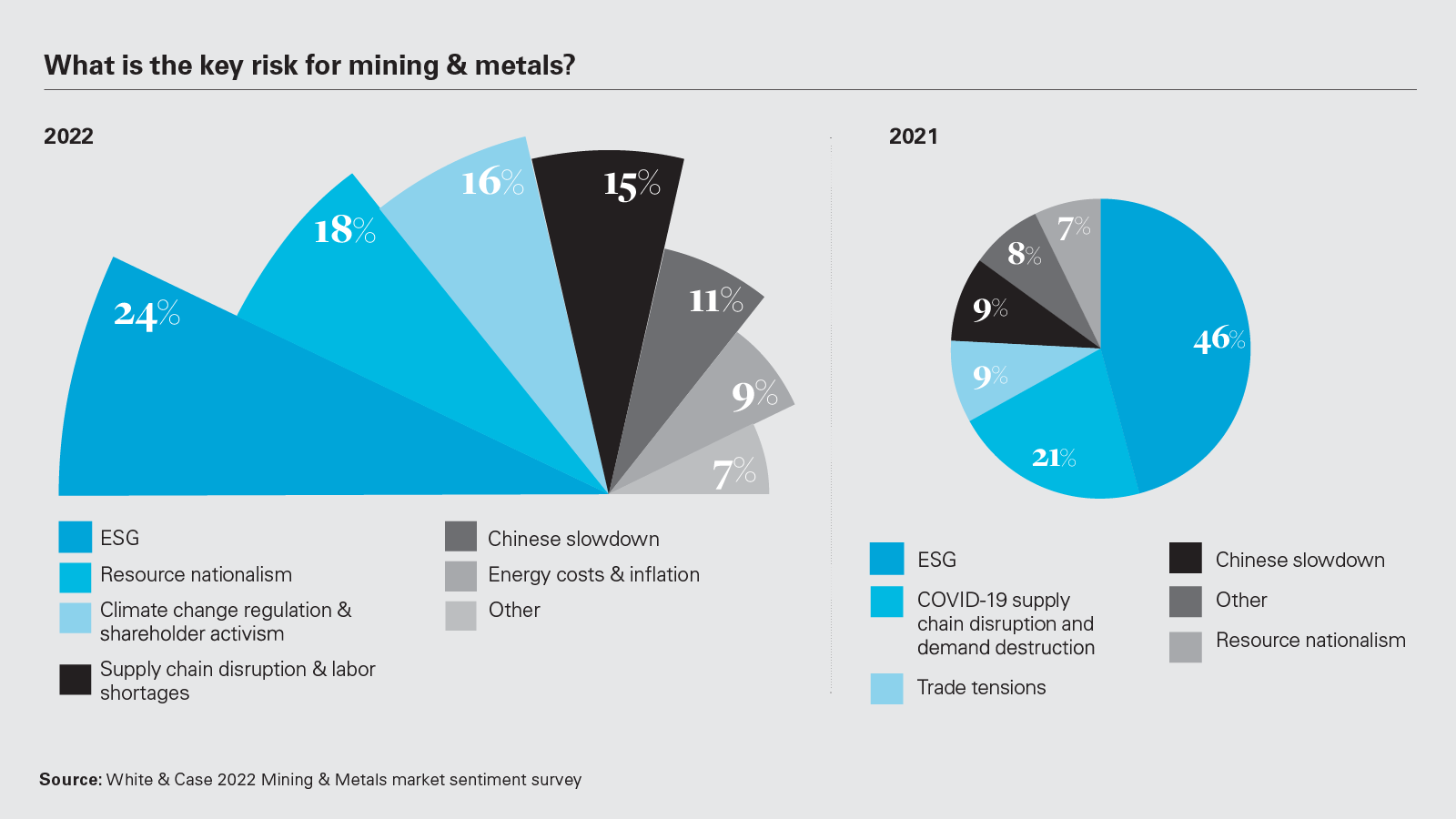

Despite the record prices, it also became clear that ESG—which has been growing in prominence in our last two surveys—is now central in terms of both attracting investors and holding a social license to operate. Companies that have focused their attention on their ESG performance are seeing the benefits.

So, what should we expect in 2022? To get an idea, White & Case has conducted its sixth annual survey of industry participants, with 63 senior decision-makers sharing their thoughts for the year ahead. While the mining & metals industry proved itself remarkably resilient to the initial shock of the pandemic, 2021 highlighted that it was also well positioned to profit from the global recovery ESG’s prominence lays platform

The mining industry has found itself caught between two competing themes when it comes to ESG. On one side comes the continued pressure from mining fossil fuels and the recent disasters that have done considerable damage to the entire industry’s reputation, such as the fatal dam collapse in Brazil and the destruction of ancient aboriginal heritage sites in Australia. More positively, however, is how the industry has become increasingly adept at making the argument that it is becoming a far cleaner—and more sustainable sector, and with this improved ESG performance—it can be a reliable and trusted partner to mine the materials that will enable the green transition. This shift opens up opportunities for the industry going forward, provided individual players can demonstrate their ESG credentials in all respects.

For the second year in a row, respondents to our survey state that ESG issues remain a […]