West Africa’s major banks could suffer a spike in loan defaults as lower oil prices and the acute economic impact of the coronavirus pandemic hits the region, analysts said.

In Nigeria, Africa’s biggest oil producer and fourth-largest banking sector by assets, lenders are heavily exposed to the energy sector. Lending to oil and gas companies represents around 40% of Nigerian banks’loan assets, according to financial research group Proshare Nigeria, while Fitch Ratings said that as of September 2019 oil and gas accounted for about 30% of Nigerian banks’ gross loans.

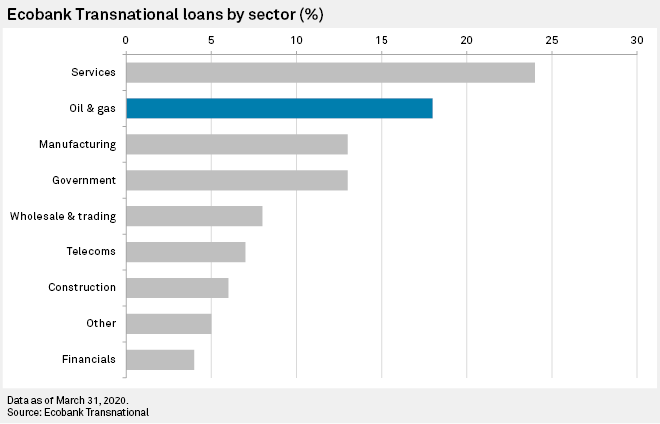

For Ecobank Transnational Inc., which is Togo-based but has a subsidiary in Nigeria, lending to oil and gas companies accounts for 18% of its loan book. "The banking sector is exposed to inherently high economic imbalances because of Nigeria’s reliance on oil and its sensitivity to currency depreciation and high inflation. This leaves banks vulnerable to asset-price shocks and asset-quality problems," said S&P Global Ratings credit analysts.

Lenders in Nigeria expanded lending last year to meet a central bank order to raise their loan-to-deposit ratios to 65%. Other factors working against Nigerian banks could include "risks stemming from further [foreign exchange] pressures, ongoing weak economic performance and rising government domestic and external debt," Ratings analysts said.

The rating agency on March 31 lowered the long-term issuer credit ratings of six Nigerian banks, including Ecobank’s Nigeria unit Ecobank Nigeria Ltd., Access Bank PLC, Guaranty Trust Bank PLC Stanbic IBTC Bank PLC, United Bank for Africa PLC and Zenith Bank PLC.

Asset quality

Ecobank Transnational warned in April that its 2020 earnings "could be adversely affected by higher provisions and lower revenues."

"More than half of Ecobank’s stage 2 loans are restructured oil and gas exposures in Nigeria," Fitch Ratings said in a May report as it downgraded the bank.

As for Nigerian banks, their aggregate nonperforming loan ratio fell to 6.6% in April from 11.0% a year earlier, according to the central bank’s most recent data.

Lenders in Nigeria are having to restructure up to 40% of their loan books, according to Stanbic-IBTC estimates, making lending terms favorable for corporate and retail borrowers in order to reduce the likelihood of default. Such initiatives may be welcome, but they risk concealing the true extent of corporate distress, said Muyiwa Oni, regional head of equities research at Stanbic-IBTC in Lagos.

"Even if impairments don’t increase, interest income will fall because loan payments are being suspended or banks have cut rates […]