Tullow Oil (LON:TLW) on Wednesday announced it was on track for achieving expectations in 2021 as oil prices continue to recover from Covid lows amid easing lockdowns and vaccine optimism.

Annual group working interest production averaged 74,900 barrels of oil equivalent per day (“boepd”), in line with the oil and gas exploration and production firm’s expectations.

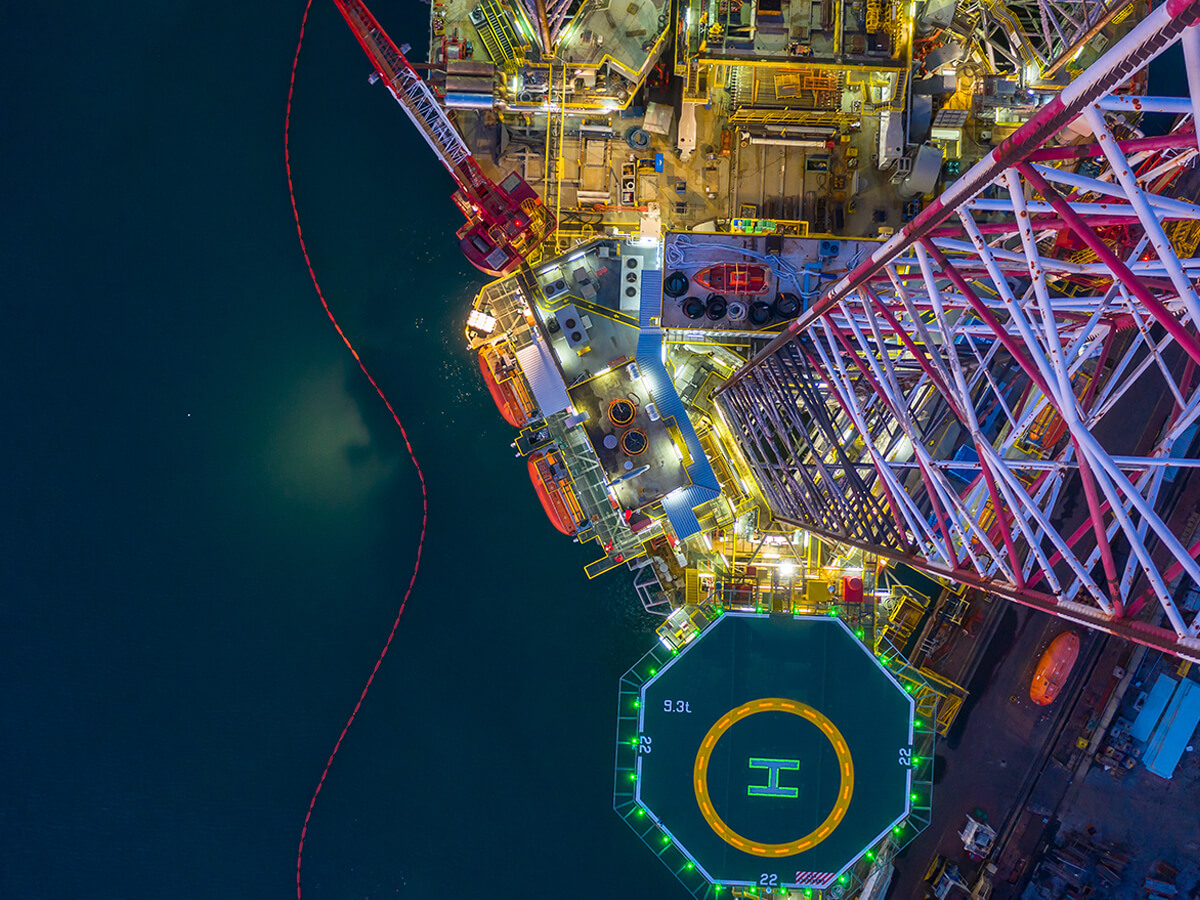

This was 12% lower than the 2019 figure of 86,800 boepd due to field decline and water cut in Ghana, where Tullow has interests in two exploration interests – the Jubilee and TEN oil fields. The field decline and water cut issues were partially offset by higher uptime for Jubilee. Opec+ production cuts also hurt some of Tullow’s Gabon fields.

So far in 2021, Tullow has kept in line with its annual 60,000 – 66,000 barrels of oil per day (“bopd”) guidance.

Elsewhere, the firm successfully shrank its 2020 annual loss to $1.2 billion from $1.7 billion in 2019 thanks to a reduction in written off exploration costs combined with a smaller net impairment of property, plant, and equipment. This came despite a decline in sales revenue to $1.4 billion from $1.7 billion.

Going forward, in 2021, the company expects to report underlying operating cash flow and pre-financing cash flow of around $500 million and $200 million respectively at $50 per barrel (“bbl”). This compares to a $598 million underlying operating cash flow and $625 million pre-financing cash flow in 2020 at a realised oil price of $50.9 per bbl.

Under its ten-year business plan, as presented in November 2020, the company will seek to generate around $7 billion of underlying operating cash flow. It is also aiming for pre-financing cash flow of approximately $4 billion. Both goals assume a price of $55 per bbl.

At the end of 2020, Tullow’s net debt stood at around $2.4 billion, with free cash of approximately $1.1 billion and gearing of 3.0 times net debt to EBITDAX,

Tullow also provided an update on its ongoing refinancing talks, noting that it now has approval for $1.7 billion of new debt capacity under its reserve-based lending facility. The company commented that: “The combination of strong business delivery, increased liquidity, recent asset sales and higher commodity prices is providing a positive impetus to constructive discussions with creditors. The group is confident that a mutually satisfactory agreement on debt refinancing can be reached in the first half of this year.” With the new debt capacity, Tullow’s liquidity headroom […]