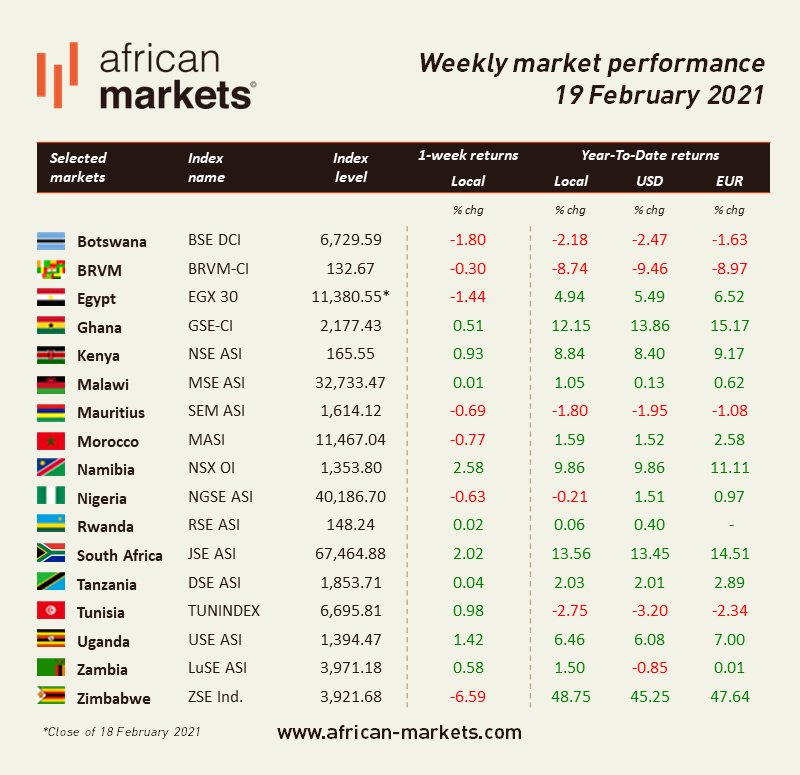

Overall sentiment on African equity markets was mixed. Among the markets we cover, 10 of them advanced this week and 7 retreated. Namibia led the pack as its benchmark index jumped 2.58%. Conversely, Zimbabwe retreated significantly, losing 6.59% over the week.

West Africa

BRVM – Bears remained active on the Western Africa regional exchange. The Composite Index lost 0.30% in a week that saw only XOF 317m (USD 0.59m) worth of shares change hands every day on average, about twice the daily average turnover of the week before. The market is now down 8.74% year-to-date and the total market capitalization stands at XOF 3,993bn (USD 7.4bn). The top performer this week is the SMB (Société Multinationale de Bitumes). The stock jumped 8.75% over the 5-day period and is now up 17.05% since the beginning of the year. The market heavyweight, Sonatel , closed the week at XOF 11,290, up 0.8% over the week. Shares in the telecom operator are down 16.37% year-to-date.

NGSE – Bearish sentiment prevailed in Lagos as stocks plunged for the third week in a row. The ASI closed on Friday at 40,186.70, down 0.63% WoW. YTD returns are now in negative territory in local currency (-0.21%). The improving yield environment in the fixed income space seems to have outweighed the news of better-than-expected GDP recovery of 0.11% YoY in the fourth quarter. A daily average of NGN 3.6bn (USD 9.6m) worth of shares was traded over the last five days. The total market capitalization stands at NGN 21.0tn (USD 55.2bn). The top performer this week is Portland Paints , a company active in the manufacturing, distribution, and marketing of decorative and industrial paints and coatings used in the building, construction, and oil & gas industries in Nigeria. Shares soared 14.44% as the company’s merger with the Lagos-listed Chemical Allied Products Plc (CAP) completes. At a court-ordered meeting of CAP’s shareholders, the company has been “authorised to receive all the assets, liabilities, product offerings, and property rights of Portland Paints and Products Nigeria Plc”. CAP Plc is hereby authorized to pay Cash Consideration of NGN 2.90 to the Scheme Shareholders for each ordinary share of NGN 0.50 held in Portland Paints as at close of business on the Terminal Date. Upon the completion of the merger, the “Enlarged CAP” is expected to dominate the Nigerian paints markets with an estimated market share of 14.9%. The […]