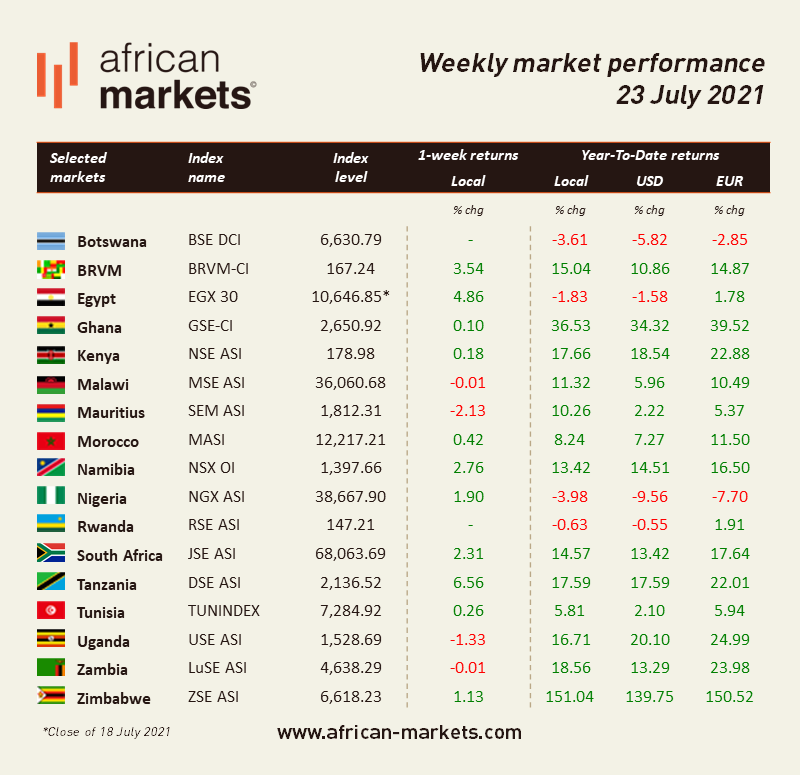

The sentiment was positive on African equity markets this week. Among the 17 markets we cover, twelve advanced while four retreated, and one remained flat. The Dar es Salaam Stock Exchange led the performance charts as Tanzanian equities jumped 6.56%. Conversely, Mauritian equities dropped 2.13%, the most on the continent. Due to the Eid al-Adha celebrations, several markets were closed for one day or more this week. West Africa

BRVM – Positive sentiment prevailed in Abidjan for the third week in a row. Overall, the Composite Index advanced 3.54% WoW to close at 167.24. Market activity increased 20% as XOF 490m (USD 0.88m) worth of shares changed hands every day on average compared to XOF 407m the week before. The market is now up 15.04% year-to-date, and the total market capitalisation crossed the five trillion XOF mark and reached XOF 5,033bn (USD 9.03bn). SIB (Societe Ivoirienne de Banque) is among the top performers this week. Shares in the financial institution jumped 12% and are up 25.93% YTD. The market heavyweight, Sonatel , closed at XOF 14,275 on Friday (+6.53% WoW). It is now up 5.74% since the start of the year.

NGX – Equities in Lagos rallied this week. The benchmark index of the Nigerian exchange gained 1.90% WoW closing on Friday at 38,667.90. Stocks are now down 3.98% YTD. Activity declined 20% as NGN 1.7bn (USD 4.2m) worth of shares were traded on average over the week. Note it was a short trading week due to the two days public holiday declared by the federal government in commemoration of the Eid el-Kabir celebrations. The total market capitalisation stands at NGN 20.1tn (USD 49.0bn). Total Nigeria Plc is among the top performers this week. Shares in the energy company gained 10% as it declared an interim dividend of NGN 4 per share during the week. The counter is up 56.31% since the start of this year. The market heavyweight, Dangote Cement , soared 7.83% to close at NGN 248 on Friday (+1.27% YTD).

BVC – Morrocan equities rallied this week as the MASI advanced 0.42% over the period. As expected, market activity dropped as MAD 28m (USD 3.1m) worth of shares changed hands every day on average compared to MAD 83m the week before. The total market capitalisation stands at MAD 628.3bn (USD 70.02bn), up 8.24% YTD. The Sothema is the second-best performer this week. Shares in the pharmaceutical […]