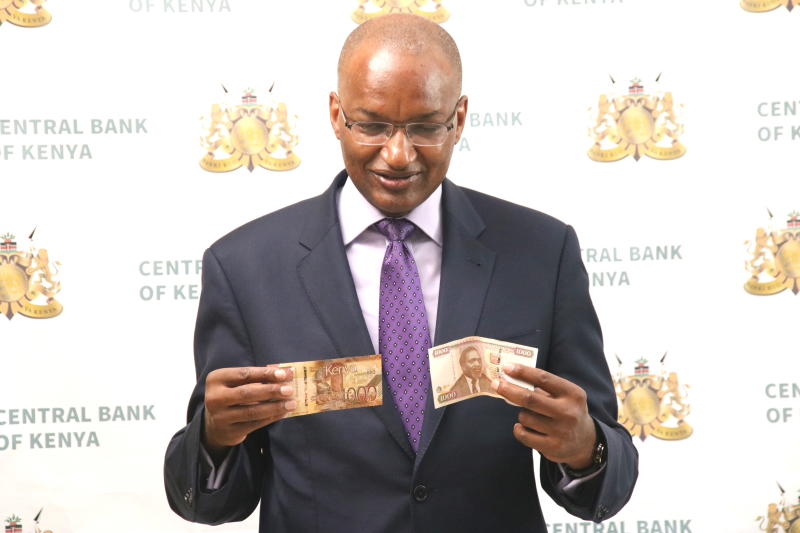

Central Bank of Kenya Governor Patrick Njoroge holds the new 1000 shilling note with the old note during the media briefing on the new currencies notes “Thanks to your hard work and commitment, our shilling has remained fairly stable and competitive.”

Central Bank of Kenya (CBK) Governor Patrick Njoroge must have been flattered by these words by President Uhuru Kenyatta.

But anyone who has been tracking the performance of the shilling against the major world currencies over the last four months would remember the president’s words with nostalgia.

His remarks came on December 11, 2018 at a time when the possibility of a virus casting a dark spell on the global economy and crashing financial markets only existed in the realm of science fiction. READ MORE

At the time, the local currency had a good run against the dollar, trading at between 100 and 103 units since June 2015 when Dr Njoroge replaced Njuguna Ndung’u at the helm of CBK.

Today, the shilling is on a free-fall. And the soft-spoken CBK governor, for long seen as the vanguard of the shilling, seems to have lost the grip on the shilling.

An astute disciplinarian, Njoroge does not hide his preference for order and stability in the financial market. Consequently, he has been tough on money changers in a bid to infuse discipline in the forex market.

Unlike his predecessor, he has also maintained an arm’s length relationship with bankers, shunning invitations for a round of golf with bank CEOs in his spare time. The running joke among bank honchos is whether they can survive the next 24 months of the no-nonsense governor.

But it is the zeal with which he has protected the shilling from cowboy-like speculation, and analysts from giving any media commentary on the shilling, that marks him out.

This has enabled him to stabilise the exchange rate, which hovered between 100 and 103 until the Covid-19 pandemic struck early last year.

The pandemic is no respecter of legacies. It has undone years of economic and financial achievements.With the onset of the pandemic, there were suddenly more dollars flowing out of the country. This put the shilling under pressure.Foreign investors pulled their money from the Nairobi Securities Exchange (NSE). And with lockdowns and prohibition on international flights, tourists stopped coming into the country.The key market for Kenya’s flowers in Europe closed down.It would have been catastrophic had it not been for the low demand for crude […]