Senate’s Finance and Budget Committee has asked the Central Bank of Kenya (CBK) to furnish it with details on the cost of loans issued by local banks via mobile channels.

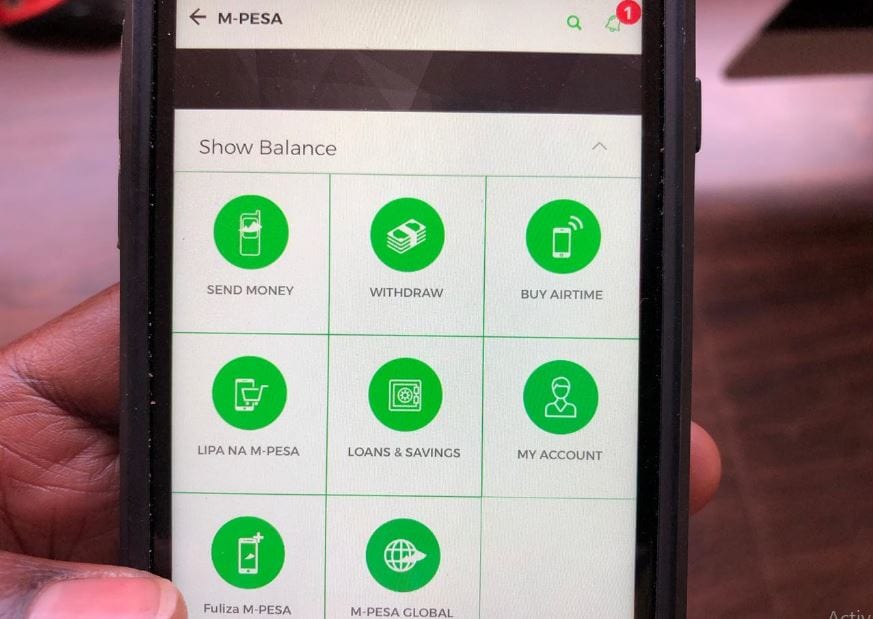

Products such as Fuliza and M-Shwari which represent partnerships between local commercial banks and telco operators have taken Kenyans by storm with millions relying on credit issued on the channels for financial support.

Senate’s Finance and Budget Committee has its fears premised on the interest rates levied by banks for the loans on an annualized basis which they worry may be a carbon copy of those passed on by unregulated lenders.

Commercial banks have been put on the spot for resembling digital lenders by saddling Kenyans with exorbitant mobile loans.

This is as the traditional lenders also opt for loan issuance via mobile applications which present avenues to slap customers with hidden fees which have the impact of raising loan costs.

Senate’s Finance and Budget Committee has asked the Central Bank of Kenya (CBK) to furnish it with details on the cost of loans issued by local banks via mobile channels.

“Regulated entities are equally charging close to 70 or 80 per cent in annual terms which is immoral for the lack of a better term,” Kericho Senator Aaron Cheruiyot said during the virtual appearance of CBK Governor Patrick Njoroge at the Committee’s hearing on Tuesday.

While digital loans have been widely tied to rogue and unregulated lenders, it is traditional commercial banks that reign supreme in mobile loan issuance.

Products such as Fuliza and M-Shwari which represent partnerships between local commercial banks and telco operators have taken Kenyans by storm with millions relying on credit issued on the channels for financial support.

For instance, according to data from Safaricom, Kenyans ‘fulizad’ Ksh.149.4 billion in just six months between March and September in comparison to Ksh112.2 billion at the same time last year.

Previous surveys have also proved Kenyans rely more on mobile loans issued by traditional banks than is the case with digital lenders.An August survey by MSME Consultancy Viffa Consult for instance ranked KCB and NCBA backed Mshwari and Fuliza as the most accessed mobile credit providers by SMEs in 2020.The survey shows the two bank-backed applications have eaten into the digital lenders’ share of SME borrowers replacing Tala and Branch who had led the pack in 2019.Senate’s Finance and Budget Committee has its fears premised on the interest rates levied by banks for […]