Kenya’s financial inclusion has drastically improved in the last couple of years through development in the financial sector. Mobile money has been a key driver in narrowing the financial access gap in Kenya.

According to FSD Kenya, M-Pesa, Safaricom’s mobile money platform, is said to have lifted 2% of Kenyans out of poverty.

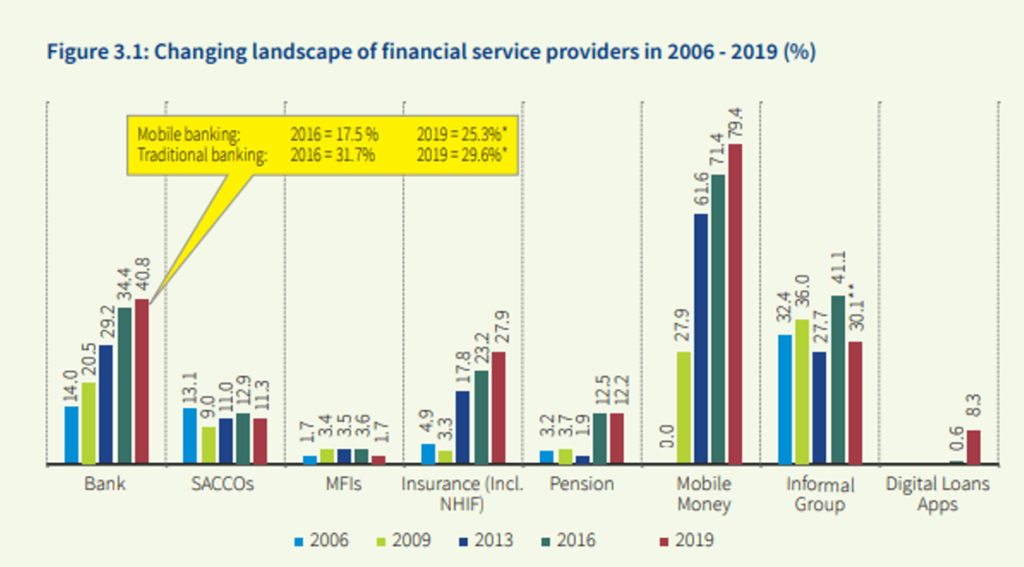

The impact is more significant in female-headed households, which had previously been limited in accessing financial services due to cultural restrictions. Financial access growth has reduced the gender gap from 13% to 6%. Source: 2019 FinAccess Household Survey Mobile money has been the main financial service used by all socio-economic groups in Kenya. It has prompted the entrance of several private investors into Kenya’s credit market as the demand for quick, small loans has been growing rapidly. In the first quarter of 2020, loan accounts in Kenya increased by 21% compared to the last quarter of 2019. About 92% of these accounts were mobile loans. Another common source of finance for Kenyans, especially the lower-income groups has been chamas. These groups offer loans to members at about 1% per month. Mobile loans and chamas have been falling through the cracks of formal lending systems, providing the lower-income groups with capital to pay school fees, do farming, expand their businesses and meet daily expenses. Reasons for taking credit

Source: 2016 FinAccess Household Survey Financial options for the poor are falling flat…

The financial services used by Kenya’s most vulnerable groups are mobile money, informal groups, banks, insurance (mostly NHIF) and digital loans. Source: 2019 FinAccess Household Survey Luckily, the low-income groups can still comfortably use mobile money, especially since the Central bank extended the waiver of M-pesa fees for transactions equal to or below Kshs 1,000. However, they are unable to access mobile loans. In April, when the Central Bank of Kenya barred mobile lenders from forwarding the names of loan defaulters to credit reference bureaus (CRBs) and stopped the blacklisting of borrowers owing less than Kshs 1,000, most mobile loan companies ceased loan disbursements and focused on getting repayments from the funds disbursed pre-COVID-19.

Usually, SACCO customers are mainly denied credit on account of failure to clear outstanding loans. Mobile money, mobile banking and digital loan apps providers deny customers credit on a bad or no credit history. Lower-income groups are the majority who make up Kenya’s informal sector or part-time workers in the formal sector who […]