In the coming years, many will be watching to see whether mobile network operators will manage to retain the 2.8 million new mobile money subscribers with affordable fees. Digital Payments

Digital Rights

Digitalisation

Financial Inclusion

Kenya

Mobile Money

Personal Data

This article is part of the series — Africa in 2021 .

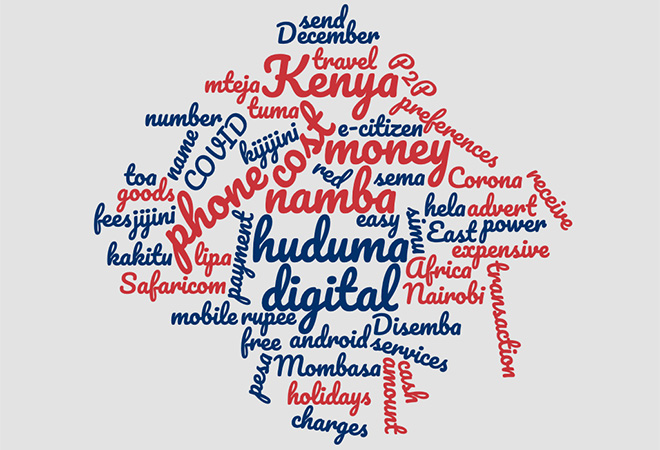

Kenya has among Africa’s highest levels of mobile penetration . It is lauded for adopting technology in both private and public uses, from mobile money to e-government services. It was, therefore, not unexpected that when the COVID-19 pandemic struck, the country turned to digital technologies to help people ease into new forms of working and learning. A raft of policy and legal measures for contactless transactions were put in place. These included directives for cost-free mobile money person-to-person transactions for transactions below Ksh. 1,000, and cost-free bank-to-mobile wallet transfers. Amendments to various laws also legitimised electronic signatures and the Judiciary developed rules on e-service, e-filing, e-payment and e-proceedings. Many of these measures were introduced shortly after Kenya confirmed its first case of the novel coronavirus, when a lockdown was imminent. They were, therefore, aimed at not only supporting a digital society with cashless transactions, but also cushioning low-income earners whose livelihoods were affected by reduced movement. The COVID-19 emergency measures on pricing of mobile money transactions demonstrate the dynamics of digitalised payments, from affordability, inclusion to regulation perspectives.

The effect of the lockdown and curfews on the economy was evident from reduced cashflows. Nevertheless, the Central Bank of Kenya (CBK) reported that mobile money transactions increased by 87 percent between February to October 2020. The COVID-19 emergency measures on pricing of mobile money transactions demonstrate the dynamics of digitalised payments, from affordability, inclusion to regulation perspectives.

Three months into the measures, the largest mobile money operator (MNO), Safaricom, protested extension of the measures , estimating that it had incurred Ksh. 19 billion in lost revenue. Statistics from the communications regulator indicate that in the period, there had been a rise in volume and value of person-to-person mobile money transactions of over 24 percent and 7.2 percent respectively. CBK noted that were were about 2.8 million new mobile money subscribers , and transactions of below Ksh. 1,000 rose by 114 percent.This data paints a very different picture from that shown by high mobile penetration rates. It indicates that there were many […]