Equity Group #ticker:EQTY is open to repurchase a stake in mortgage lender HF Group, signalling a shift in its appetite to acquire rivals in the Kenyan market.

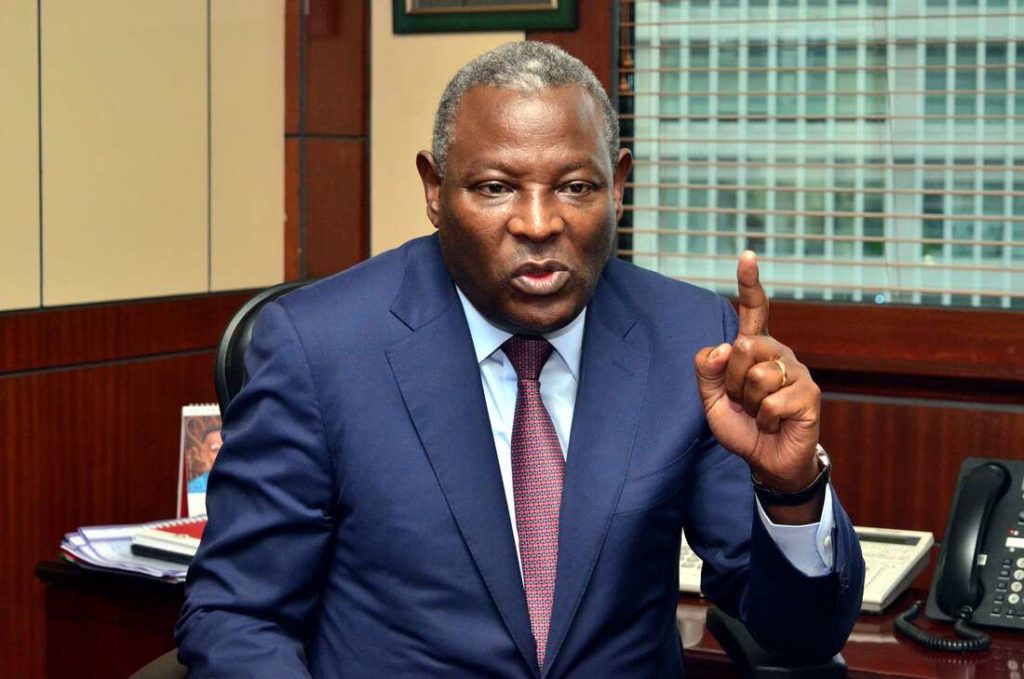

Equity chief executive James Mwangi said the bank would review its interest in HF, seven years after selling its 24.7 percent stake to insurance group Britam.

Britam plans to sell part of its 48.2 percent stake in HF Group to one of the country’s big banks as part of its investment portfolio review.

“We exited from HF Group …but if it becomes available, we would evaluate it just like we evaluate other opportunities,” Mr Mwangi told the Business Daily in an interview.

The disclosure coincides with Equity’s plans to buy a local rival if a target emerges, a shift to inorganic growth plan in Kenya.

The bank has been focused on expanding locally by growing its customer base and adding physical branches, favouring acquisitions abroad in markets like Democratic Republic of the Congo.

Equity also operates in Tanzania, Rwanda, Burundi, South Sudan and Uganda, and has a representative office in Ethiopia.

Britam in March said it would sell majority stake in HF Group to focus on insurance business.

Potential suitors will be seeking to ride on HF to grow into the mortgage market.

HF is ranked third in the residential mortgage business with 11.2 percent market share, having lent Sh26.09 billion to 4,101 house buyers as of December 2020, according to Central Bank of Kenya data.

Stanbic Bank Kenya is ranked second with a 13.1 percent market share having lent Sh30.54 billion in the same period.KCB is the leader with Sh69.06 billion loans to 8,837 customers.Equity holds five percent market share having lent Sh11.52 billion to 1,898 customers and harbours ambitions of a larger stake of Kenya’s homes loan market.HF’s market capitalisation stands at Sh1.46 billion and valuing Britam’s stake at Sh703 million.The price at which the insurer will sell its stake in the impending transaction is expected to be based on negotiations with interested investors.Britam invested in HF with the goal of accessing new customers and expanding its real estate investment portfolio with the mortgage financier which has been in the property business for decades.HF, like other mortgage lenders, has suffered in recent years due to the capping of lending rates between September 2016 and November 2019, a slowdown in the real estate market and more recently the economic fallout from the Covid-19 pandemic.The planned buyout of HF will continue the […]