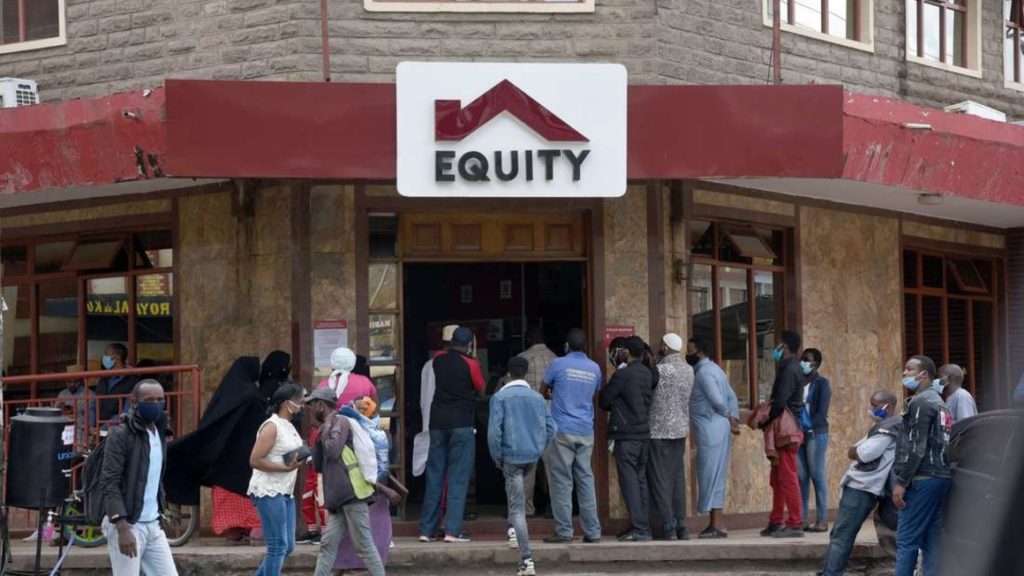

Customers wait to gain access to Equity Bank in Eastleigh, in Kenya’s capital Nairobi. Equity Group Holdings has been allowed to merge two DRC banks that it acquired. PHOTO | FILE | NMG Equity Group Holdings has received regulatory approval to merge Equity Bank Congo (EBC) and Banque Commercial du Congo (BCDC) to form DR Congo’s second largest lender by assets.

The new bank, to be known as Equity Banque Commercial du Congo (Equity BCDC), holds more than $2.5 billion worth of assets, 74 branches and has a customer base of nearly one million.

“This is an important milestone and a great New Year gift to our customers in the DRC. Equity BCDC will immediately have a single obligor limit of $40 million. This will enable our customers in the DRC to access higher credit limits to grow and expand their business ventures,” said James Mwangi, the Group’s chief executive, in a statement last week.

“Equity BCDC is now part of an international bank with presence in six countries enabling our customers to do cross border trade with ease.”

The bank has operations in the DRC, Kenya, Uganda, Tanzania, South Sudan, Rwanda, and has a representative office in Ethiopia.

On December 29, 2020, the Group received approval from the Central Bank of Congo to merge the two subsidiaries (BCDC and EBC) into one bank.

Bank branches and other outlets of both EBC and BCDC are expected to begin changing their name and brand identity to Equity BCDC. Majority shareholding

The merger comes after Equity Group acquired 66.53 percent shareholding of BCDC from Belgian entrepreneur George Arthur Forrest and family.

Equity Bank already had operations in the DRC through a subsidiary it established by acquiring an 86.6 percent stake in the German bank ProCredit between 2015 and 2017.

The subsidiary has now been renamed Equity Bank Congo (EBC) SA.

In 2019, Equity Bank increased its shareholding in EBC SA to 94.3 percent by acquiring an additional 7.7 percent of the shares held by the German state-owned development bank KfW.The remaining 5.7 percent shareholding in EBC SA is held by IFC.After the merger of EBC SA and BCDC, Equity Group will hold a majority 77.5 percent stake in Equity BCDC, with the remainder being held by IFC, the DRC government and minority shareholders.BCDC was majority-owned by the Forrest family (66.53 percent), government of the Democratic Republic of Congo (25.53 percent), and minority shareholders (7.94 percent).Equity BCDC has the financial muscle […]