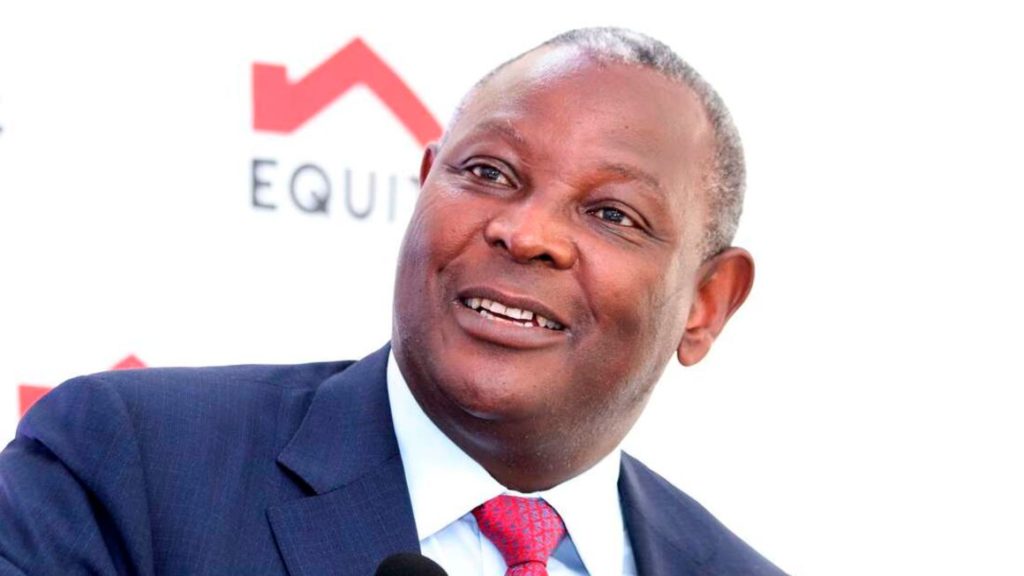

Equity Group Managing Director and CEO Dr James Mwangi at the Equity Centre in Nairobi on Monday, October 25, 2021. PHOTO | DENNIS ONSONGO | NMG Equity Group has received a licence to operate a life insurance business in Kenya as the company seeks growth and diversification in the financial services industry.

The Insurance Regulatory Authority (IRA) issued the licence to Equity Life Assurance (Kenya) Limited (ELAK), a subsidiary of the Nairobi Securities Exchange-listed firm.

This marks Equity’s first direct venture into the insurance sector after more than a decade as an agent of established underwriter Britam Holdings through a bancassurance agreement.

“Our inspiration is to offer insurance to all categories of consumers and make insurance accessible, affordable and inclusive in line with our purpose of transforming lives, giving dignity and expanding opportunities for wealth creation,” Equity CEO James Mwangi said in a statement.

Kenya’s Sh235 billion annual insurance market is dominated by general insurance with mandatory motor and medical policies.

Motor and medical insurance, however, have huge claims and high loss ratios which may have informed Equity’s strategy to target long term products.

Equity has chosen life insurance which comprises Sh102 billion in annual premiums or 43.4 per cent per cent of the overall insurance business.

“Our market, however, is still general business driven and I call upon Equity Life Assurance to identify strategies of increasing insurance growth in the long-term business,” IRA chief executive Godfrey Kiptum said.

Equity’s entry into insurance has been enabled by legal and regulatory changes that allowed lenders to go into non-banking businesses after undergoing the necessary corporate restructurings.

Most of the big banks have transformed into non-operating holding companies which are free to own banking and non-banking subsidiaries.

The holding companies are, however, still regulated by the Central Bank of Kenya.Equity Group formed Equity Group Insurance Holdings Limited to house its underwriting business, the first of which is ELAK.The licensing of ELAK comes as Equity’s long-term bancassurance partner Britam is selling its remaining stake in the bank to the International Finance Corporation (IFC).Britam will earn Sh13.9 billion from the sale of a 6.7 percent stake in the bank, marking its exit from the 17-year investment.