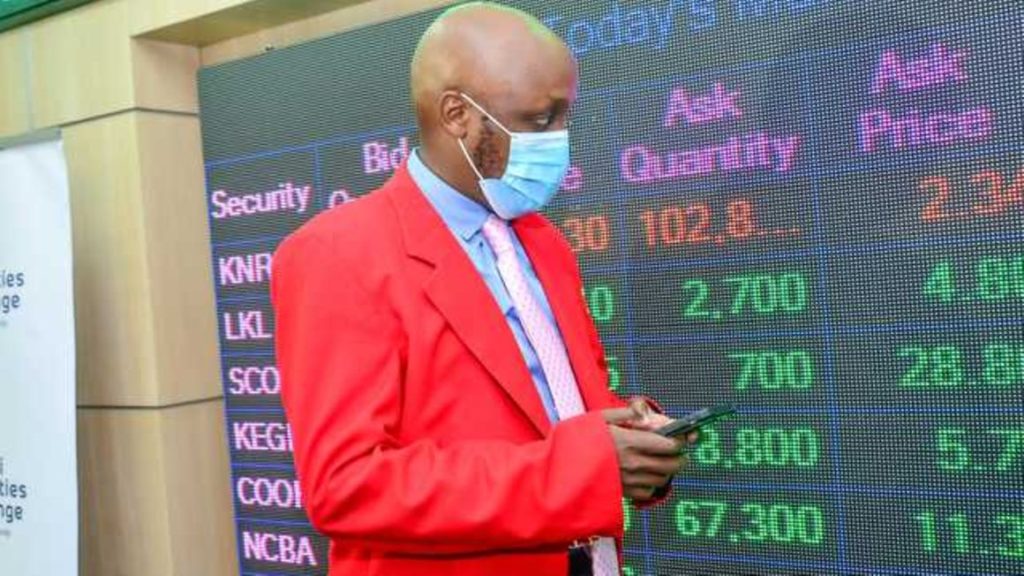

Retail and institutional investors have been seeking higher guaranteed returns on the Nairobi Securities Exchange. PHOTO | FILE Both retail and institutional investors have been seeking higher guaranteed returns available from government securities, as earnings from other asset classes such as equities and cash deposits remain low.

The government’s large appetite for debt also fuelled the additional trading activity on bonds with the high number of issuances introduced into the market, raising fears that the private sector is being starved of credit.

Meanwhile, money market funds continued to perform better than all the other asset classes in 2021, for the second year in a row, due to their higher returns.

The move to fixed-income investments in the Covid-19 pandemic period raised transactions in bonds at the Nairobi Securities Exchange to a record $8.37 billion last year, nearly seven times the value of equities traded on the bourse.

Both retail and institutional investors have been seeking higher guaranteed returns available from government securities, as earnings from other asset classes such as equities and cash deposits remain low.

The government’s large appetite for debt also fuelled the additional trading activity on bonds with the high number of issuances introduced into the market, raising fears that the private sector is being starved of credit.

Over the past year, Treasury sold a net of $6.76 billion in new bonds that were subsequently traded actively at the bourse.

“The bonds market outpaced the 2020 numbers by 38.44 percent to $8.37 billion from $6.05 billion registered in 2020; this is a record high in trading activity recorded. Equity turnover declined by 7.58 percent to $1.2 billion, from $1.29 billion posted the previous year,” said the NSE.

The rise in bond turnover generated more commissions for the bourse operator and the stockbrokers who handle the trades in debt securities. The bonds market was also seen as a haven for investor cash after the pandemic hit the country and contracted the economy by 0.3 percent in 2020. Increased holdings

Retail traders in government bonds — comprising Saccos, listed and private companies, self-help groups, educational institutions, religious institutions and individuals — increased their holdings of the securities by $867.7 million to $2.17 billion during the year.

However, equities became riskier and less attractive in investors’ eyes, as listed firms recorded diminished profits and cut dividend payouts to preserve cash in a difficult operating environment.The shares market has struggled to break free of the bear […]