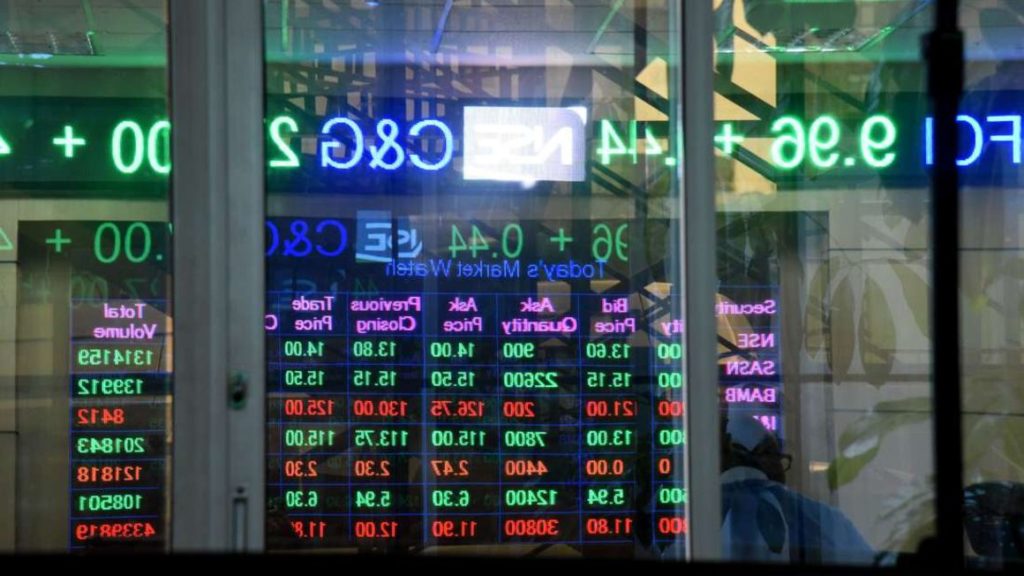

Nairobi Securities Exchange trading floor. PHOTO | NMG Kenya and Saudi Arabia are some of the most prominent economies in their respective regions. The two countries account for an enormous percentage of Gross Domestic Product in the Middle East and East Africa respectively.

Coincidentally, the two countries have economic blueprints with a similar name and completion period; The Vision 2030. Although materially different on account of economic size, the blueprints seek to create globally competitive economies leveraging on the respective country’s investment capabilities, strategic locations, natural resources and a youth demographic to spur economic growth and enhance quality of life.

Guided by its economic blueprint, Saudi Arabia has implemented strategic financial market developments that have enhanced the country’s attractiveness to foreign investors providing a sturdy boost to the country’s equity and bond markets.

To put this into better perspective, the Tadawul Stock Exchange, Saudi Arabia’s sole stock market has seen its market capitalisation as a percentage of nominal GDP grow from approximately 64.35percent in 2015 to 346.7percent as at the end of 2020. Similarly, the country has been able to attract significant equities investment through the Tadawul Stock Exchange over the last few years.

Saudi Arabia’s growth in attracting foreign direct investments through financial markets is a masterclass on how domestic financial markets can play a significant role in promoting economic development through facilitating cross-border capital inflows.

Below are key the lessons from Saudi Arabia that can enhance increase direct foreign investments in Kenya through the Nairobi Securities Exchange (NSE).

PRIVATISATION OF STATE ASSETS

Saudi Arabia has adopted a structured, time sensitive privatisation programme for its state-owned assets. To support its privatisation objectives, the country set up the National Centre for Privatization (NCP) in 2017. The NCP identifies and prepares Government assets for privatisation developing a robust pipeline of state enterprises which could be privatised or improved through private sector participation.

The results have been evident. The privatisation of state assets such as Aramco (world’s largest oil producer), have marked a decisive point in broadening Saudi Arabia’s appeal to foreign investors. It has equally enhanced the depth and sophistication of Saudi’s equity market with positive spillover effects in the country’s financial services sector. Other notable privatisations include the privatisation of the country’s milling sector with consortiums to bid for stakes in other state-owned assets sent out.

Saudi Arabia foresees potential exits in multiple state-owned assets within the next few years with the Government targeting to raise […]