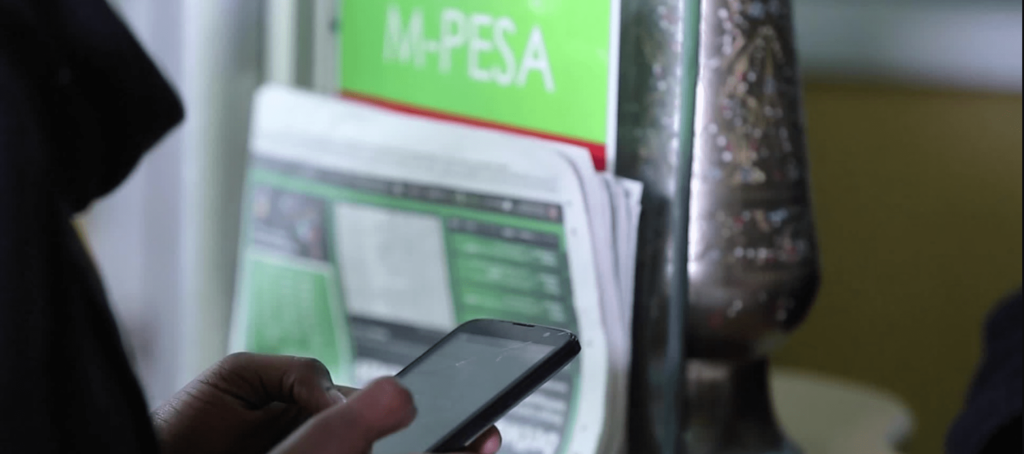

According to a pre-earnings note by Genghis Capital the company’s M-Pesa revenues are set to decline by 14.8 per cent from last year with the free peer-to-peer transactions of below Ksh.1000 and free M-Pesa to bank transfers weighing heavy on the previous growth.

The revenue stream is further expected to take a hit from the depressed economic activity which has had the net effect of impacting transaction values.

Revenues from funds transfers represent about 30 percent of Safaricom’s M-Pesa revenues as per the company’s last financial year disclosures.

Free mobile money transfers below Ksh.1000 implemented in mid-March are expected to curve a part of Safaricom’s profit when the company publishes its half year results next Monday.

According to a pre-earnings note by Genghis Capital, the company’s M-Pesa revenues are set to decline by 14.8 per cent from last year with the free peer-to-peer transactions of below Ksh.1000 and free M-Pesa to bank transfers weighing heavy on the previous growth momentum.

“Revenue from funds transfer contributed to 30 percent or a respective Ksh.25 billion to total M-Pesa revenue in the last financial year, this segment is the most exposed to the emergency measures,” the note published on Friday stated.

The revenue stream is further expected to take a hit from the depressed economic activity which has had the net effect of impacting transaction values.

On March 16, the Central Bank of Kenya (CBK) resolved to have mobile-money operators waive fees on all mobile money transactions below Ksh.1000 in a means to trim physical cash handling to mitigate the spread of the pandemic.

The reserve bank would later extend the waiver to the close of 2020 at the end of June much to the protest of operators including Safaricom whose request to cap the maximum number of transactions between Ksh.1000 was denied by CBK.

On its part, Safaricom has since projected a Ksh.19 billion hit to its M-Pesa revenues for the year to March 2021 even as CBK refused to be engaged in a public discourse on the matter.

“The total value of our contribution to the fight against this pandemic currently stands at Ksh.6.5 billion and continues to grow everyday. We estimate the impact on M-Pesa payment support will increase to about Ksh.19 billion by the end of the year,” former Safaricom Chairman Nicholas Ng’ang’a told shareholders on July 30.It remains unclear on whether the CBK will extend the emergency measures beyond December 31 even as it […]