In a tumultuous year dominated by the coronavirus pandemic, financial markets have seen a return to the kind of volatility last seen a decade earlier in the financial crisis. No matter how well they are managed, exchanges are still sensitive with respect to the direction of the market. One way to view them is as a call on the next bull market – they remain profitable in a bear market and could become interesting money machines in the next upturn.

The three months to the end of December saw the FTSE Mondo Visione Exchanges Index up by 8.9%. Greece’s Hellenic Exchanges was the best performing exchange in the quarter with Euronext being the worst performer.

The FTSE Mondo Visione Exchanges Index ended the month up 7.2% at 72,499.80 points, up from 67,638.94 on 30 November 2020, setting a new closing all time high of 72,499.80 on 31 December 2020.

Hong Kong Exchanges & Clearing Group ended December as the world’s largest exchange operator by market capitalisation.

The top 5 exchanges by market capitalisation at end December were:

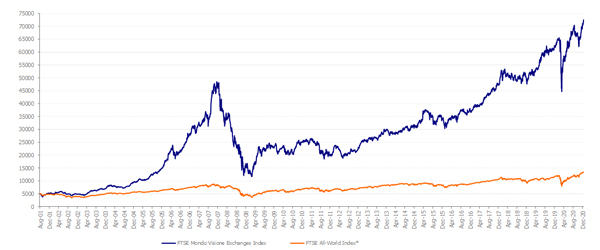

FTSE MONDO VISIONE EXCHANGES INDEX AND THE FTSE ALL-WORLD INDEX PERFORMANCE SINCE 17 AUGUST 2001 (USD CAPITAL RETURN) Herbie Skeete, Managing Director, Mondo Visione and Co-founder of the Index said: "There was no shortage of M&A activity in 2020. The purchase by Nasdaq of anti-money-laundering specialist Verafin, S&P Global’s purchase of IHS Markit, London Stock Exchange Group soon to be completed acquisition of Refinitiv, the acquisition by Deutsche Boerse of Institutional Shareholder Services are prime examples of the consolidating global exchanges, financial data and information services space as data providers seek to join the dots, with the intention of providing an integrated set of products capable of inter-operating providing full support to the trading process and the surrounding ecosystem across all asset classes now and yet to be invented, enabled or indeed patented by Big Exchange Tech. Where will this all end? Perhaps with financial infrastructure behemoths being too scary and big for regulators to stomach." Andre Cappon, President of The CBM Group , a New York- based consultancy focused on capital markets said: "Exchanges and market infrastructures are in the middle of yet another wave of consolidation. The initial wave, which occurred in the years 2000-2008 was about in-country, regional and global consolidation. That wave is mostly over in the Americas and Europe, though it may still have some room to run in emerging markets. […]