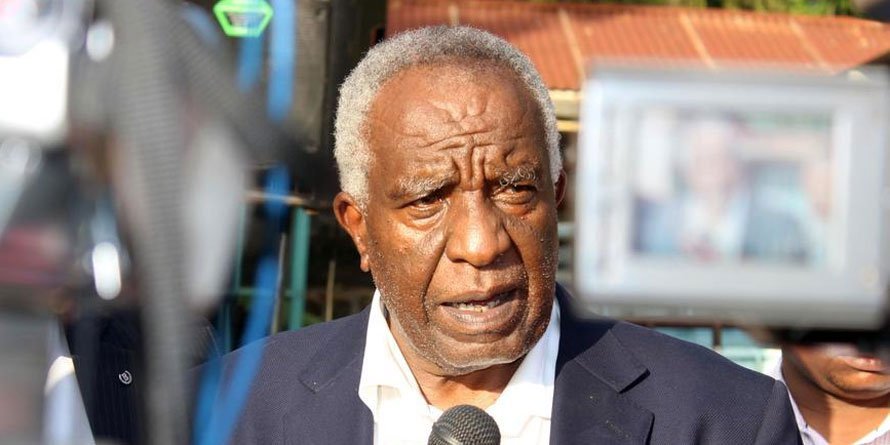

Billionaire businessman Peter Munga in 2016 pocketed Sh135.7 million worth of dividends from Britam #ticker:BRIT shares he did not own, an inquiry report shows.

The tycoon inked a secret deal with top officials of Mauritius government giving up the rights to earn dividends on the shares before Mr Munga acquired the stock.

The insurance firm declared a dividend of Sh0.3 per share for the year ended December 2015.

The book closure date — the day when the company’s share registrar determined who would be eligible for the dividends — was June 9, 2016.

Mr Munga through his investment vehicle Plum LLP signed an agreement to buy 452.5 million Britam shares from the government of Mauritius a day later on June 10, 2016.

This meant that the island nation qualified for the dividend, which was paid soon after the Nairobi Securities Exchange-listed firm held its annual general meeting on June 24, 2016.

But Mauritius officials agreed to certain clauses in the agreement with Mr Munga that saw the island nation surrender its right to the dividend, marking one of the lopsided arrangements that triggered an investigation in Port Louis.

Mauritius was to receive the dividend through the National Property Fund Limited (NPFL), which was created to manage the Britam shares that were part of assets seized from its citizen Dawood Rawat, whose Sh71 billion ponzi scheme exploded in 2015.

The loss of the accrued dividend is among the major issues that were investigated by the commission of inquiry besides the sale of the Britam shares to Mr Munga for Sh7.1 billion in disregard of higher offers of Sh11 billion each from South Africa’s MMI Holdings and Barclays Bank (now Absa Group).

This left the government of Mauritius with a Sh3.9 billion loss, prompting an inquiry that Kenyan officials were reportedly reluctant to support.

“As per these clauses, the NPFL would never be entitled to the 2015 dividend. This is not usual or good practice,” the inquiry report says.“The commissioner therefore considers that NPFL had been unfairly deprived of an amount of approximately R43 million [Sh135.7 million] representing dividend calculated on the basis of Sh0.30 yield per share for the year ending 2015 in view of the fact that the completion date referred to at clause 6.2 of the special purchase agreement is well after the June 10, 2015.”Britam’s 2016 accounts confirm that the dividend of Sh0.3 per share declared for the year ended December 2015 was paid in full amounting […]