In 2004, the late Naushad Merali purchased 60 percent ownership of Bharti Airtel Kenya from the then-largest shareholder, Vivendi, for $230 million (Ksh18.2 billion).

An hour later, he sold the shares to Celtel, making a $20 million profit (Ksh1.6 billion according to the then prevailing exchange rate of Ksh79.2 per US Dollar).

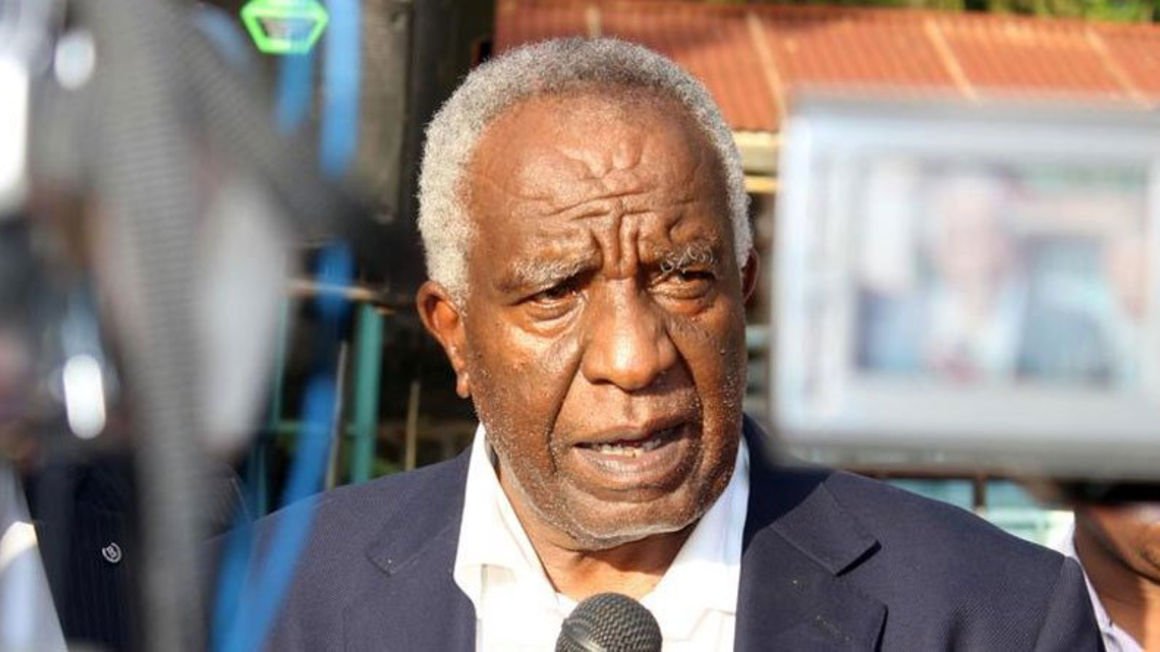

Fast forward to March 12, 2016, when businessman and former Equity Group chairman Peter Munga sought to replicate the same, this time through the Mauritian government, his company Plum Investments and Britam Holdings.

The Mauritian government had just seized 452.5 million shares of Britam Holdings from its citizen Dawood Rawat Bramer who had been running a Ksh71 billion Ponzi scheme.

Mauritius did not want to keep the shares and was willing to sell them to the highest bidder. World Bank Group’s International Finance Corporation (IFC), Barclays Bank (now Absa) and South Africa’s MMI Holdings placed their bids, offering between 4.3 billion Mauritian rupees (Ksh11 billion) and 4.5 billion Mauritian rupees (Ksh11.5 billion).

Read: Inquiry Finds That Peter Munga Pocketed Ksh136 Million From Shares He Did Not Own

Munga’s Plum Investments offered 2.4 billion Mauritian rupees (Ksh6.1 billion), a sum that was too low compared to other bidders.

Nevertheless, Plum Investments won the bid and bought the shares, despite being the lowest bidder, occasioning a Ksh5.4 billion loss to the Mauritian government.

That was not all.

Kahawa Tungu understands that Munga, hoping to execute the deal Merali-style, had borrowed the money he used to buy the shares from the Britam shareholders’ kitty.

Note that Plum Investments bought the shares despite being the lowest bidders. The plan was to resale them almost immediately to a local parastatal at a profit, but that flopped.With a ‘secret’ debt to pay and a failed deal, Munga was forced to sell the shares to the next available buyers, the international investors, who then bought at a lower price than what Plum Investments paid.Read: Equity Bank Founder Peter Munga Accused Of Swindling Business Partner Ksh150 Million The proceeds of the shares sale, though in deficit, was returned to Britam with a loss, that has now been passed to Britam shareholders. This means that Britam experienced a loss in book value, that was pushed to shareholders to protect Munga.All this happened as the Capital Markets Authority (CMA) watched without any regulatory scrutiny.According to a presidential inquest by the United Nations Economic and Social Commission for Asia and the Pacific on the sale of […]