Ugandan fintechs have registered increased uptake in services during the lockdown As people and businesses continue to feel the negative impact of Covid-19, Uganda’s economy and way of life have slumped, with several innovations halted, and in some cases, collapsed.

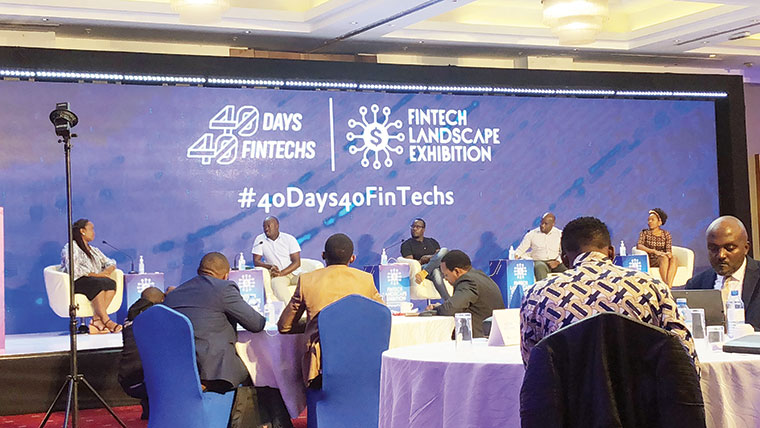

However, the urge for creativity has created a silverlining for fintechs, whose importance has skyrocketed. As FRANK KISAKYE writes, last weekend’s Fintech Landscape Exhibition at Sheraton hotel highlighted Covid-19’s enormous opportunities for the success of fintechs.

In his 1959 speech, US President John F. Kennedy famously declared, “In the Chinese language, the word ‘crisis’ is composed of two characters, one representing danger and the other, opportunity.”

The interpretation of the Chinese character has since been dismissed as the wrong one, but the context of the speech is still relevant and applicable – now even more so by Ugandan fintechs amidst the current coronavirus disease pandemic.

Fintech refers to the industry applying technology to financial services. So, a fintech company uses technology and innovation that aims to compete with traditional financial methods in the delivery of financial services.

When the country went into a preventive total lockdown in March this year to stop the spread of coronavirus, the business sector came to a near standstill. Many businesses have been predicted never to recover from the crisis, but for Ugandan fintechs, the crisis has presented enormous opportunities.

Having registered their biggest growth and deserved acceptance thus far, Ugandans fintechs now ‘selfishly want the crisis to continue’ as more and more business and customers apprehensively adjust and realign their operations to digital and online in the ‘new normal.’ Ugandan fintechs are providing mobile wallets, agricultural value chain digitization, agency banking, e-banking/mobile banking, and merchant collections, among other services.

OPPORTUNITIES

At the Fintech Landscape Exhibition at Sheraton hotel last week organized by HiPipo, nearly all the 41 fintechs featured under the 40-days-40-Fintechs initiative say they registered the biggest sales/downloads and usage in the four months of lockdown than ever before.

A similar traction is registered by similar businesses, social networking, and gaming platforms worldwide. Neilsimms Sangho, the country director of Flutterwave Uganda, says at least small 4,400 companies worldwide have been signed up for their services during the lockdown period.

Flutterwave provides fast and seamless payment solutions for businesses to start to make and receive payments from any part of the world. Sangho says some did not even have a website or delivery system in place before.“The pandemic has forced people […]