Starting January 1st, you will once again incur transaction costs when you send money that’s more than KES. 100. The measures introduced by the Central Bank of Kenya back in March that made transactions below KES. 1,000 free, are coming to an end. Whether this is due to pressure from companies like Safaricom who have reported a huge loss of revenue from the free transitions, it is not known. However, according to CBK, the measures that were put in place back then have proved to be very effective leading to an additional 2.8 Million customers using mobile money.

Of importance to note is that not all measures introduced back in March are coming to an end. Going forward a lot of the things CBK introduced are expected to remain. CBK has also come up with a new set of principles the say should guide payment service providers with guidelines to follow when setting prices for mobile money services. You can read them in the ANNEX Section below CBK’s statement on this page.

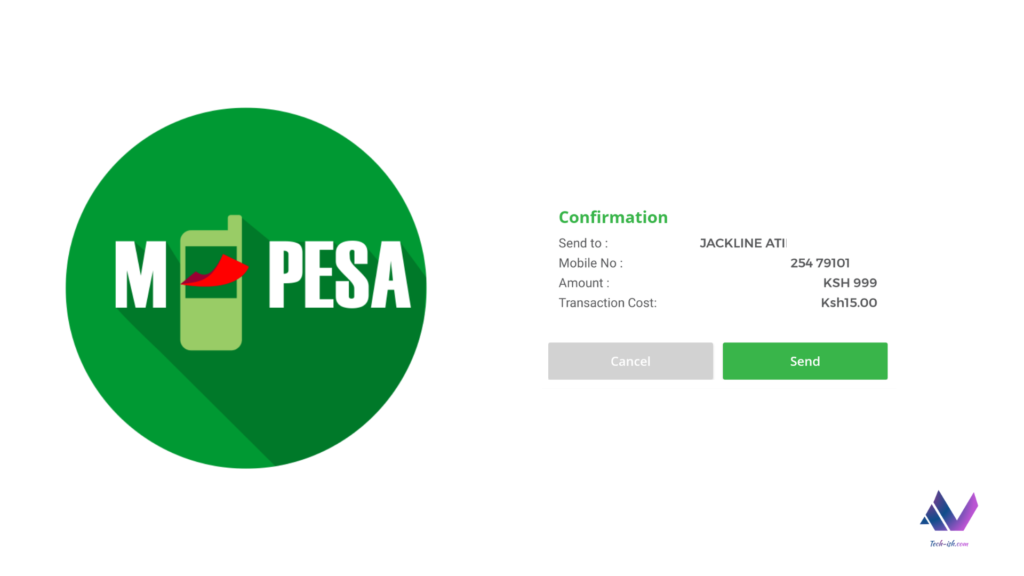

With the coming year, we should expect to see new a new pricing structure for transactions from different mobile money companies. Safaricom for one is expected to revise M-Pesa transaction costs, especially for the transactions below KES. 1,000. It will be quite hard to make Kenyans go back to paying the quite high fees that have been there when they’ve been used to free transactions throughout the year . These are the new measures effective 1st January 2020 are as follows:

> Transactions below KES. 100 will be free to any customer and network.

Transactions between Bank Accounts and Mobile Money Wallets to be free. This is great news! Hope NCBA LOOP is listening.

Transactions between SACCOs and Mobile Money wallets may attract a fee as overseen by the CBK.

Companies will propose pricing structures that adhere to the Principles set by the CBK.

Mobile money wallets will still hold up to KES. 300,000 and transactions limit will remain at KES. 150,000 per transaction.

For now, we wait for the revised transaction rates from M-Pesa, the biggest mobile money company in the country. Their revision will automatically affect all the other smaller mobile money providers in the country.

Check out the official statement from the CBK: Official Statement from the Central Bank of Kenya on the end of free mobile money transactions below KES. […]