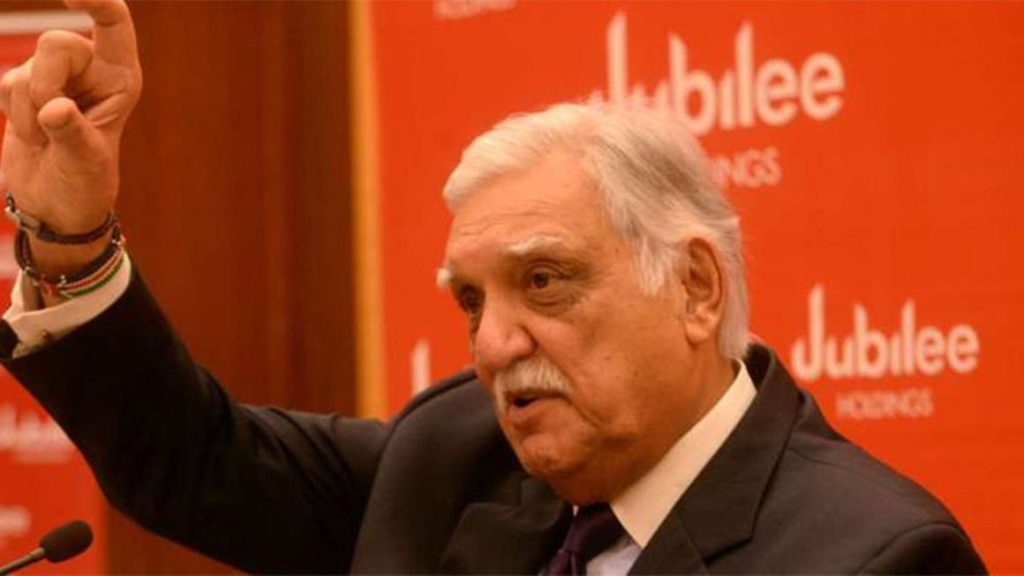

Jubilee board chairman Nizar Juma. PHOTO | SALATON NJAU | NMG Jubilee Holdings #ticker:JUB plans to expand its life and medical business using the Sh7.7 billion it will receive in its deal with Munich-based insurance giant Allianz SE.

The Nairobi Securities Exchange-listed firm is selling majority stakes of between 51 percent and 66 percent in its short-term insurance units in Kenya, Uganda, Tanzania, Burundi and Mauritius to Allianz.

The company says in a circular to shareholders that it will use the cash raised from the transaction to buy securities and invest more in its life and medical businesses.

“Your board intends to reinvest the proceeds from the sale to accelerate the expansion of its remaining life and medical businesses and invest the balance in financial instruments and other investments to earn competitive investment returns,” the insurer said.

“Jubilee will continue to serve its life and medical insurance clients with increased focus on these rapidly growing insurance segments across our core markets.”

MINORITY SHAREHOLDER

Shareholders have already voted to approve the proposed deal with Allianz.

Jubilee says the transaction will allow it to realise a significant premium on the shares sold while simultaneously retaining exposure to future growth opportunities as a minority shareholder.

“Based on the results of this analysis –your board concluded that the negotiated consideration for the proposed transaction is reasonable in the circumstances and is higher than the intrinsic investment value attributable to the equity stakes that Jubilee Group would be selling to Allianz in the proposed transactions,” the insurer said.

Stanbic Bank Kenya advised Jubilee in the deal, one of the largest in the insurance sector in recent years, as the independent transaction adviser.