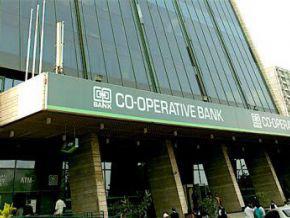

(Ecofin Agency) – Co-operative Bank, listed on Nairobi Securities Exchange, has launched new financial products aimed at Kenyan Micro, Small & Medium-sized Enterprises (MSMEs).

Thanks to these products, small businesses can borrow up to Ksh2 million ($20,000) via their cell phones, take unsecured commercial loans and services such as import finance. The banking institution has also elaborated non-financial services such as training programs and company creation and development tools.

“The MSME customer of today is more exposed to emerging business trends that are both exciting and at the same time volatile; trends that are driven both by local as well as global dynamics. This customer therefore expects adaptive banking solutions. For us to remain relevant and meet the specific needs of this customer, we have had to re-engage, refresh and reposition our offering ”, Arthur Muchangi, Ag. Director of Retail & Business Banking said.

He also reminded that in March 2018, Co-operative Bank received $150 million from the International Finance Corporation to finance Kenyan MSMEs in the agriculture, trade and device design sector.

Chamberline Moko