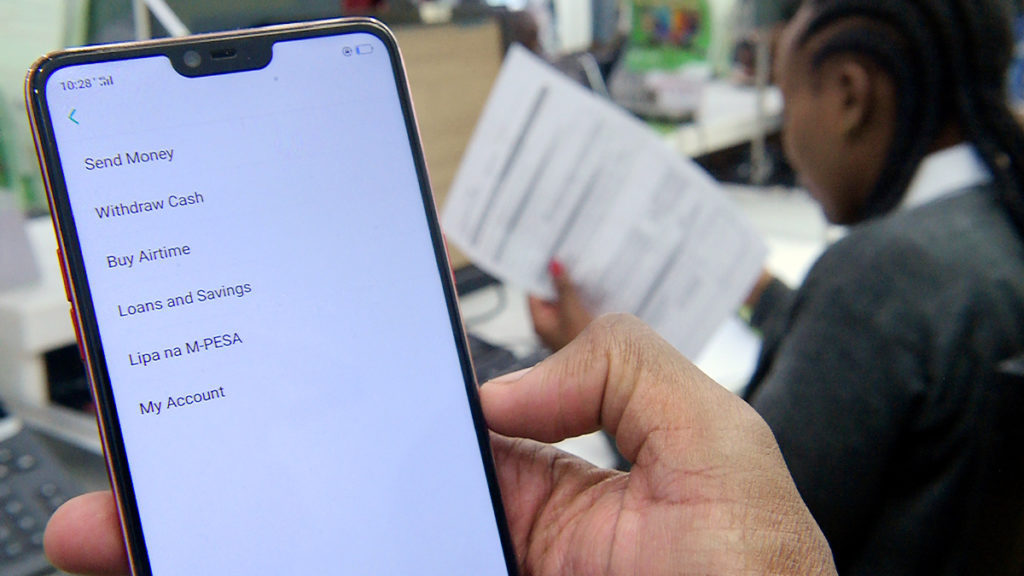

A Safaricom employee displays the M-Pesa money transfer service on a smartphone inside a mobile phone care centre in Nairobi on November 22, 2018. Summary. For more than half a century, the U.S. was the center of global innovation for financial technology, inventing credit cards, ATMs, and online banking. Now, however, it’s falling behind, as China has become a leader of mobile payments, and now African countries…

For over sixty years, the U.S. was the leading innovator of financial technology (or FinTech) in the world. Over the past decade, however, China has become the global leader: Powered by smartphones and social apps, China has used remote payments and the digitization of money management to build a steady vehicle of financial inclusion. But it may not be the leader for long. Recently, African countries such as Nigeria and Kenya have emerged as FinTech hotbeds, and are using inexpensive, accessible tech to mobilize consumers in ways never seen before. To stay competitive, U.S. banks and FinTech companies need to study the factors enabling these successes abroad — and figure out how they can keep pace.

Simply defined, FinTech is the application of technology and innovation to solve the needs of consumers and firms in the financial space — think credit cards, online banking, and blockchain-powered cryptocurrencies. While it’s arguably just the latest update to the millennia-old evolution of credit, contracts, and banking, FinTech was one of the most explosive fields of the past decade. Venture capitalists, traditional finance firms, governments, and even the average smartphone user each had a hand in the massive acceleration of its growth. Advancements like remote payments, app-based stock trades, and automated insurance claims became commonplace. The IMF cited estimates of over $50 billion invested in the field during the first half of the 2010s, with triple-digit year-over-year growth being the norm.

The development of modern FinTech stretches back further than a few decades, however. There are three major waves of innovation, each centered in a major region at a particular time. While the U.S. produced the first major wave of innovation in this sector, it has fallen behind as firms and consumers have reached the innovative doldrums of “good enough.” But by studying where FinTech has gone, and where it’s going, U.S. companies can still catch up. The FinTech Century: 1950–2050

The first wave of modern FinTech produced technologies that define how we use money today, and the bulk […]