T

he Kenya National Assembly’s Sports, Culture and Tourism Committee has revised a section of the Gaming Bill 2019 which bars gamblers and betting companies from undertaking mobile money or cash transactions. As part of the amendment, mobile money services will now be accepted by gaming operators as an authorised means of payment.

The Kenya Parliament introduced the Gaming Bill in 2019 to monitor the system of gambling operators by imposing hefty payable taxes, a mandatory 30% local ownership and disallowing gaming ads.

A section of the bill had explicitly stated that licensed gaming operators could only receive payments from players via credit/debit cards, electronic bank transfers or any other method approved by the board, Technext reports.

Mobile money platforms were not listed as one of the accepted modes of payments in a rather surprising development considering that mobile money platforms are predominantly used to process payments across Kenya. The country has about 58 million mobile money subscribers – 4 million more than the entire Kenya population of 54 million.

While the amendment has now effectively recognised that statistic, the Kenyan Legislature is proposing the prohibition of credit/debit card payments by gamers. The minimum amount for an online gambling bet has also been increased by 100% from a previous KSh50 to KSh100. According to the legislators, the move is an attempt to “discourage” gambling and crack down on illegal gambling in the country.

The amendment of the 2019 Gaming Bill is possibly part of the Kenyan government’s plan to generate more leading mobile money operator M-Pesa revenue from its legalised billion-dollar gambling industry. A 2019 PwC audit revealed that Kenya is Africa’s third-largest gambling market behind only Nigeria and South Africa.

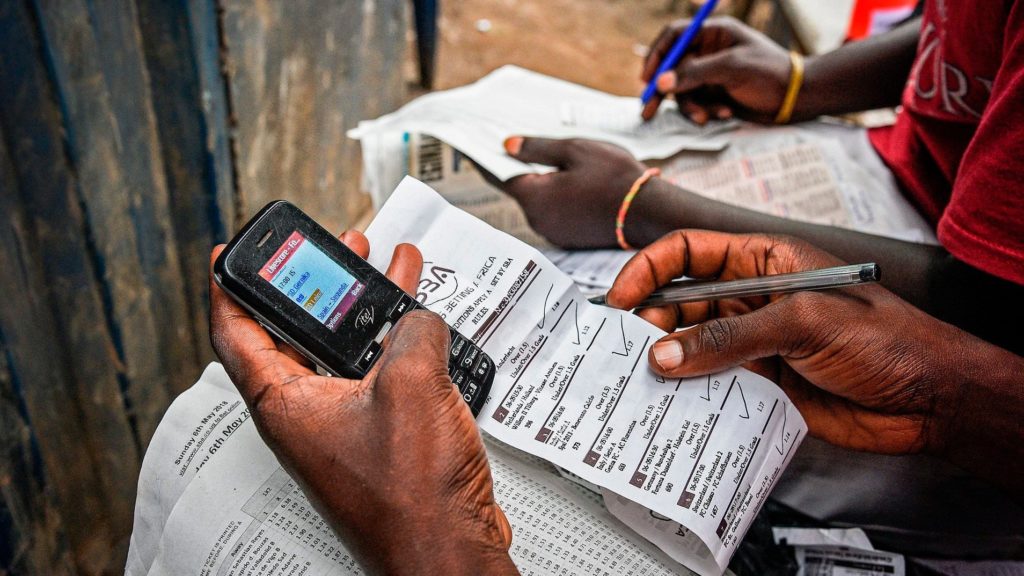

Kenya’s gambling market is heavily dominated by sports betting on mobile phones. According to GeoPoll, 88% of gamblers in Kenya have placed bets using their mobile phones. M-Pesa possesses up to 99% of the mobile money market share in Kenya. The platform offers financial services to about 42 million subscribers in the country. Earlier this year, M-Pesa’s intellectual property rights were acquired by Safaricom and Vodacom from Vodafone in a joint venture deal. The Kenya Government owns a 35% stake in Safaricom – which recorded about 20% rise in full year profits to $747 million following the acquisition.