It is no news that Kenya has been a pacesetter in Africa when it comes to the adoption of mobile digital payment. But it now seems that the country has set not just a regional but a global pace when it comes to mobile money usage.

A new research now reveals that Kenya and Ghana have the second and third highest mobile payment usage in the world after China, indicating Africa’s potential in modern finance.

The report, dubbed Five Strategies for Mobile-Payment Banking in Africa , was done by American research firm Boston Consulting Group (BCG). It estimates that the total value of global mobile financial services transactions in 2020 is between KES 1.6 quadrillion and KES 2.1 quadrillion yearly.

Despite the lower smartphone penetration rate compared to China, the two African nations are reportedly playing a huge role in underscoring the relevance of mobile money payments as the world moves to cashless systems.

According to the study, mobile money transactions in Kenya represent 87% of the country’s Gross Domestic Product (GDP). In Ghana, they account for 82% of the economy’s GDP.

Although the numbers for mobile transactions are generally strong in Africa, they are not necessarily consistent across the continent.

“Kenya and Ghana, with their relatively mature mobile payments sectors, account for much of the business in Africa. In most other countries in the region, less than 50% of financial transactions occur through mobile payments,” the report states.

Already, 400 million consumers across sub-Saharan Africa use mobile payment banking systems to handle KES 32.5 trillion worth of mobile money transactions. This has generated KES 21.6 trillion in mobile banking fee charged to customers.

The report goes on to project that the figures could go even higher with 650-750 million users adopting mobile payment by 2025 in Africa.

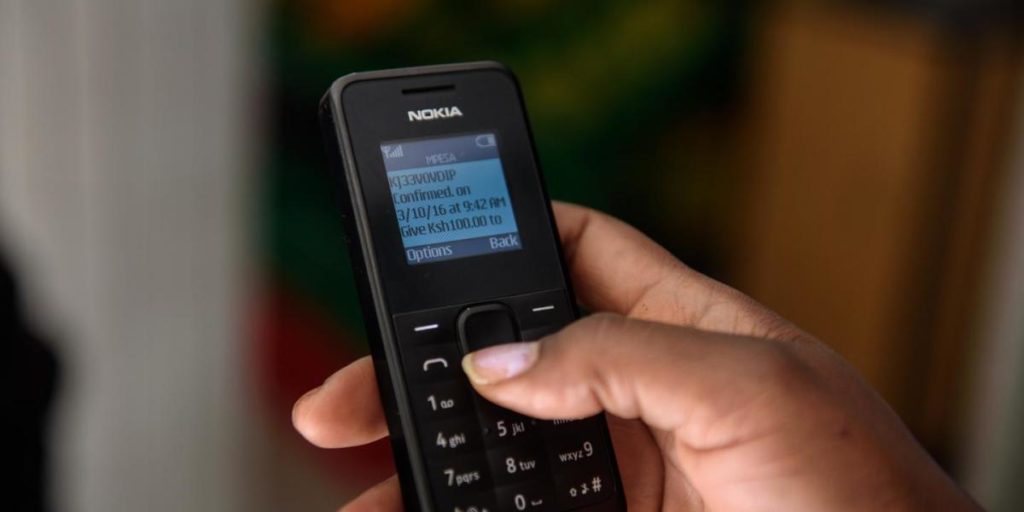

Additionally, the study acknowledges that Africa and particularly Kenya was the birthplace of the concept of a mobile wallet with the launch of Safaricom’s M-PESA in 2007. That has gone on to inspire the worldwide adoption of the idea with the global momentum in the mobile payments industry moving to China and other continents.

There is also no doubt that the mobile payment space is bound to get much bigger especially now in the midst of the pandemic when a physical cash payment is not a recommended option.