•Last month, the utility firm suspended all 59 procurement and supply chain heads to pave way for a forensic audit to identify areas of possible revenue leakages.

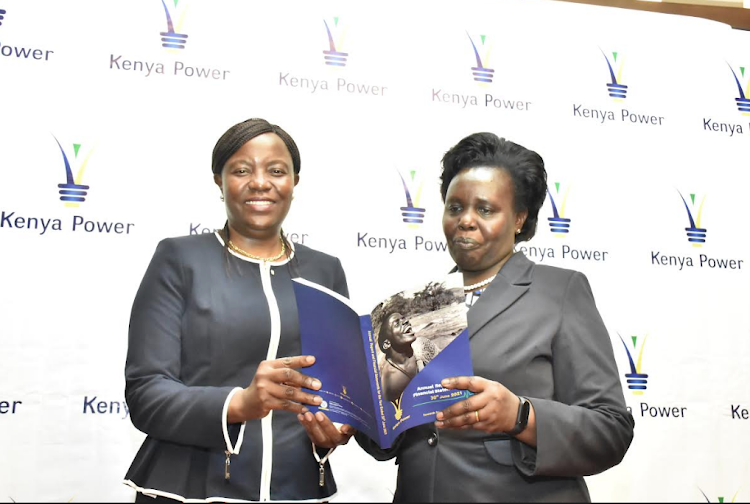

•It is keen to take legal action and seize fraudulently acquired assets. Kenya Power board chairman Vivienne Yeda and Kenya Power acting managing director and CEO Rosemary Oduor, during the company’s 100th AGM held on Friday/HANDOUT Kenya Power shareholders have agreed to legal action and asset recovery from employees found to have used their official positions for personal benefit.

This is in the wake of forensic and lifestyle audits being pushed by the company, as part of reforms to seal revenue leaks mainly through procurement processes, and improve the company’s bottom line.

The lifestyle audit is in line with recommendations by the Presidential Task Force on Power Purchase Agreements, which released its report on September 29, advising on a number of measures to bring down the cost of power and streamline operations at the company.

Poor financial performance has seen shareholders go for four years without dividends, something management wants to change with the ongoing reforms.

“The ongoing reforms, spearheaded by the board, are geared towards delivering sustainable profitability for the business and ultimately guaranteeing a steady growth in shareholder value in the short term,” chairman Vivienne Yeda notes.

Ninety nine per cent of shareholders who attended the company’s Annual General Meeting on Friday, 99 per cent endorsed legal action and seizure of assets of those found to have been involved in fraudulent deals.

“That the board of directors takes all possible legal action against all persons, employees of the company, suppliers and any other persons, found to have been involved in conflict of interest between their duties and the company’s business thereby causing loss and damage to the company,” read part of the resolutions.

The resolutions shared with the Nairobi Securities Exchange yesterday also shows shareholders voted that the company “should pursue legal action with a view to undertaking a surcharge against the employees, including the past senior executives and other senior persons who have served in management in the company.

National Treasury holds a majority stake of 50.1 per cent.

Together with other 19 shareholders, mainly nominees through banks and investment vehicles, they control a 63.5 per cent stake valued at about Sh4.9 billion.This is on 1.9 billion ordinary shares at Sh2.50 each.Other shareholders hold a 36.5 per cent stake, which includes wealthy individuals.Total shareholders as at June 30, 2021 […]