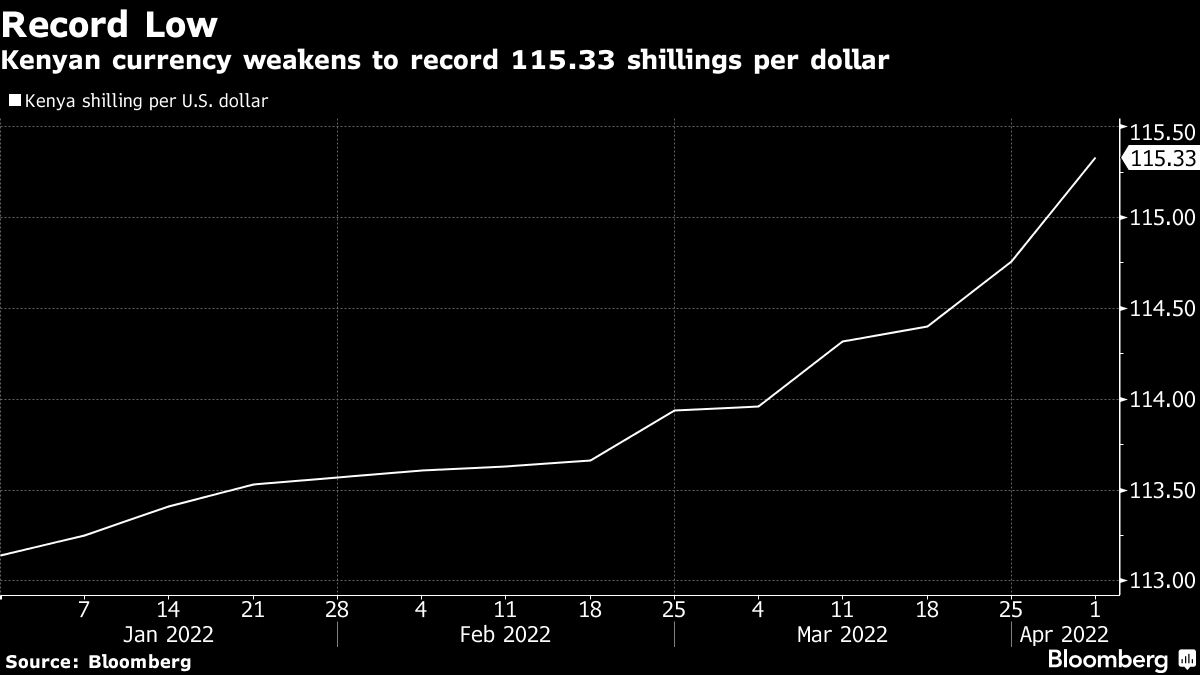

Kenya’s shilling weakened to the dollar for the 10th consecutive month in March as the dampening global economic outlook accelerated its rate of depreciation.

The currency of East Africa’s largest economy reached 115.35 per dollar on Friday, having depreciated 1% in March and 1.7% in the first quarter, according to data compiled by Bloomberg.

The global outlook has worsened in the past two months following Russia’s invasion of Ukraine, surging prices of oil and other commodities, decades high inflation in the U.S. and some countries in Europe as well as lingering concerns over the resurgence of Covid-19. Remittances, Kenya’s largest source of foreign exchange, are expected to continue growing as the cost of sending money back home for Kenyans living in the diaspora falls, central bank Governor Patrick Njoroge said on Wednesday. Transfers jumped 22% to $338.7 million in January from a year earlier, after reaching a record $3.72 billion in 2021.

Increased dollar demand is being driven by local companies disbursing dividends to foreign investors, IC Group economist Churchill Ogutu said by phone. Safaricom Plc, Kenya’s largest company, declared an interim dividend of 25.6 billion shillings ($222.5 million) that was due for payment by the end of March.