BC-Kenyan-Bank-Stocks-Set-to-Drive-Market-Gains-EFG-Hermes-Says , Eric Ombok (Bloomberg) — Kenya’s biggest banks are the key to further gains for the benchmark Nairobi stock index this year as investors bet on the nation’s recovery from the pandemic, according to EFG Hermes Kenya.

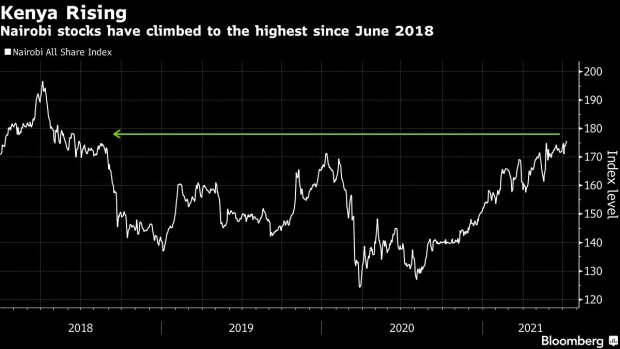

The Nairobi All Share Index has gained 16% in 2021 to the highest in more than three years. Expectations that the central bank will approve risk-based lending, increasing funding to the private sector, should see banks help the market to build on that advance, said the firm’s head of equities, Muathi Kilonzo.

“The big overhang really for the whole sector is the approval of the risk-pricing models from the central bank, and that’s going to be the catalyst,” Kilonzo said in an interview.Profitability at Kenyan lenders is showing signs of improvement, according to central bank figures. Combined industry pretax profit in the three months ended March almost doubled to 45.9 billion shillings ($425 million) from the 23.6 billion shillings recorded in the preceding quarter.

Among preferred banking stocks, Kilonzo said Equity Group Holdings Plc had negotiated the pandemic “a lot better than its peers.” In addition, its expansion strategy in the Democratic Republic of Congo is winning plaudits, he said.

EFG Hermes said KCB Group Plc is well-positioned to benefit as the Kenyan economy normalizes “and people get back to lending and transacting,” he said.

The outlook for local market giant Safaricom Plc, which accounts for 63% of the main index, hinges on progress in efforts to build its business in Ethiopia.

Ethiopia Awards New Telecoms License to Vodafone Consortium

“To a large extent, Ethiopia isn’t really in the price, so investors right now are still giving Safaricom some space,” Kilonzo said. “They want to see how this opportunity rolls out and they want to see particularly how mobile money comes into the picture.”

©2021 Bloomberg L.P.