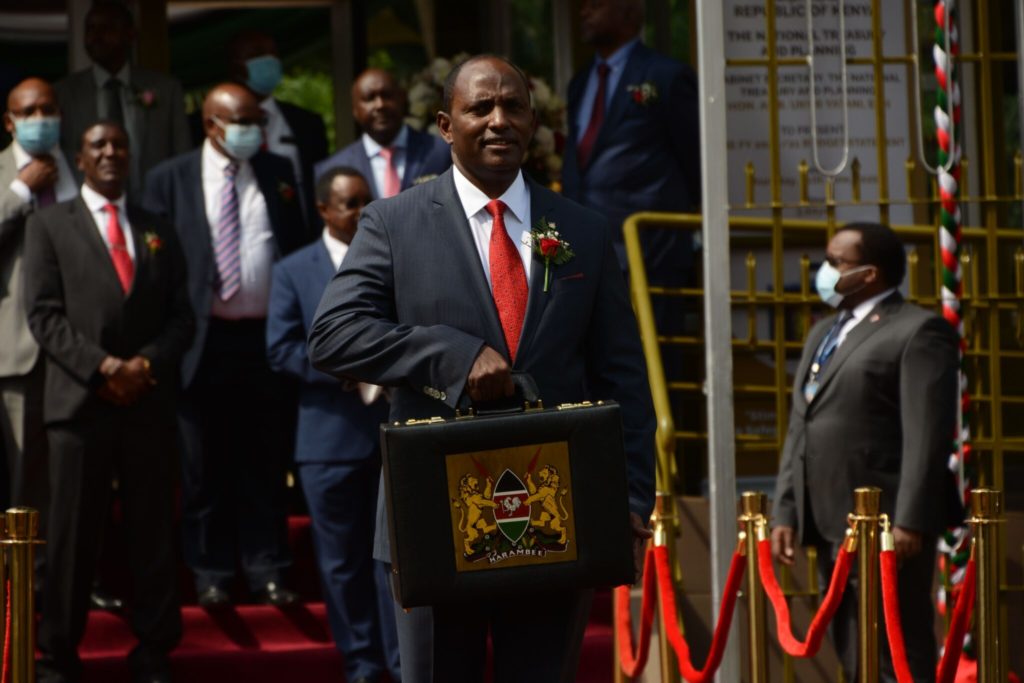

Cabinet Secretary for National Treasury in Kenya Ukur Yatani poses for a photo outside the National Treasury building with the budget briefcase before leaving for Parliament to read the 2020-21 budget. Credit:Dennis Sigwe Kenyan Treasury officials are basing their debt-restructuring plans on the expectation of a bounce back from the effects of Covid-19 on tourism and commodity exports.

Although the budget deficit is predicted to widen to 8.7% of GDP, the government will have to borrow more. Government debt is expected to exceed 66% of GDP and debt-servicing to take up to 27% of state revenue over the next three years. Treasury plans

The Treasury will raise at least KSh124bn (US$1.24bn) by June 2022 on the Eurobond market. This move is part of a planned debt restructuring of around KSh350bn ($3.5bn) of principal repayments.

The size of the Eurobond will depend on how much cash the government can raise from the World Bank, the IMF and the African Development Bank. That is likely to be composed of KSh262bn from the IMF’s extended credit facility and a loan of around KSh70bn from the World Bank.

The government is also reported to have secured the deferment of some $600m in service payments on public and private debt until the end of June. Will it work?

Yet with the government having just taken control of the Standard Gauge Railway project and in the process of writing off more Kenya Airways loans as it effectively nationalises the airline, the government’s debt burden and contingent liabilities, via state companies, is set to rise over the next three years.

Local analysts say that the government’s forecast of a KSh931bn budget deficit now looks extremely optimistic and that hefty tax rises look likely. Fuel duty has already increased by KSh8 per litre.

The government’s rapid Economic Stimulus Programme and ‘Post Covid-19 Economic Recovery Strategy’ was supposed to help grow the economy by 5.8% in 2021. That growth target looks unlikely to be met with some restrictions on businesses still in place and the tourism and service sectors still hit by the pandemic. Bottom line

As the Jubilee party government enters a rocky political period ahead of the 2022 elections its economic priorities will be jobs and the cost of living, both of which have come under heavy pressure since the pandemic started a year ago. Much will depend on how quickly the government can roll out its vaccination programme, its main […]