New cost cutting measures

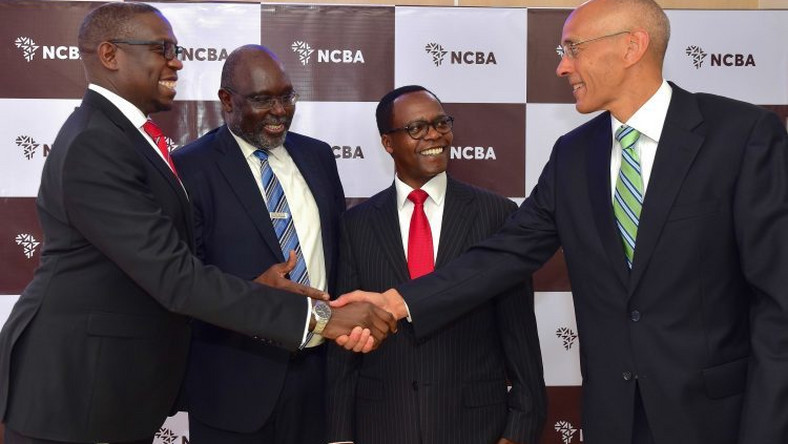

Kenyatta family owned NCBA bank closes down 14 branches as it seeks to cut down costs during Covid19 crisis NCBA, a bank owned by President Uhuru Kenyatta and his family has permanently shut down 14 branches as it seeks to cut operational costs amid the effects of the coronavirus.

The company had initially said the closure of some of its branches would be temporary immediately after the Covid19 crisis started in early April.

However, the new decision was reached to permanently shut down a total of 14 branches spread across the country.

Eight of the branches previously operated as NIC while six operated as CBA before the two banks merged to form NCBA which is now the third largest bank in Kenya with regard to assets.

" On April 1, 2020, the bank announced the temporary closure of eight branches in response to Covid-19. After careful consideration, we have decided to permanently close seven of these branches. In addition, we have identified another seven branches, which will be permanently closed ," the bank said in a statement to its customers.

It was not immediately clear if the new development would lead to job losses from redundant employees.

Last year, the Competition Authority of Kenya approved the merger of NIC and CBA on condition that the development would not lead to some employees being declared redundant.

“ The authority has approved the proposed merger between Commercial Bank of Africa Ltd and NIC Group Plc on condition that none of the employees of the merged entity is declared redundant within 12 months of closing the transaction in Kenya ,” Competition Authority of Kenya Director-General Wang’ombe Kariuki said.

NCBA has adopted aggressive cost cutting measures as it recently acquired a car yard to cater for mechanical repairs of the vehicles it intends to auction from loan defaulters .