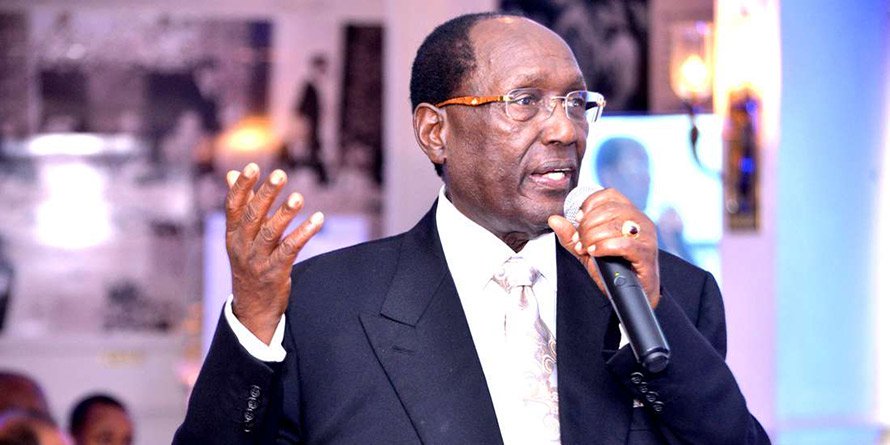

Billionaire investor Chris Kirubi. FILE PHOTO | NMG Billionaire investor Chris Kirubi is yet to start buying additional shares in Centum Investment Company after announcing on March 23 that he would spend about Sh2.7 billion to acquire an extra 20 percent stake in the company.

August regulatory filings show that the businessman still maintained a 30 percent equity in the company whose stock, at Sh20.95 apiece, is trading at a 70.6 percent discount to its net asset value per share of Sh71.3.

Mr Kirubi’s announcement made it seem like he was ready to start accumulating the shares on the cheap, with the Covid-19 pandemic sending the stock to the current lows. The businessman now says he will take his time to raise his stake to 50 percent.

“I have no time limit on the share purchases,” he said, adding that he has no opinion on whether the stock could go up or down in the short term.

He also hinted at reassessing his decision to make the huge investment.

“You don’t want to have all your eggs in one basket,” he said in reference to the risks of portfolio concentration.

While Mr Kirubi has investments in many companies, including International House and Bayer East Africa, Centum has come to represent a substantial part of his wealth. His holding in the investment firm was valued at highs of Sh12 billion in 2015 –the year when the last bull market ended. His stake is currently valued at just Sh4.1 billion, a paper loss of Sh8 billion or 66 percent.

To acquire the extra 20 percent stake in the company, he will buy a total of 133 million shares in the open market.

This marks his latest bid to boost his ownership in the firm that invests in real estate, private companies and government bonds. He bought a 4.9 percent stake in Centum in the two years to August 2015 at a cost of more than Sh1 billion, resulting in his current 30 percent interest in the Nairobi Securities Exchange-listed firm.

Mr Kirubi has previously said he would only sell his shares at a price of more than Sh100 apiece, implying that the prevailing market price represents a major undervaluation of the firm’s worth.

Like most other stocks on the NSE, Centum has been the victim of the prolonged bear market that got new momentum from the pandemic this year.Its share price had rallied to highs of Sh78 in September 2014 on […]