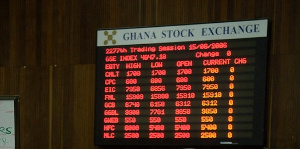

The benchmark composite index close the period at 2,766.80 Despite an uptick in activity, the Ghana Stock Exchange (GSE) saw volume and value of shares traded dip 64.98 percent and 45.09 percent respectively on a year-on-year (YoY) basis in January, according to data from the Accra bourse.

This comes as aggressive profit-taking anchored on the market closing on a three-year high, coupled with concerns over macroeconomic conditions – inflation, foreign exchange volatility, fiscal deficit, and uncertainty over the impending E-levy – continue to bite.

This saw the benchmark composite index (GSE-CI) close the period at 2,766.80 – representing a year-to-date (YtD) loss of 0.81 percent. Consequently, the GSE-CI tumbled from its position as second among its continental peers to fifth: behind the Nigerian Exchange All Share Index (NGX ASI), Johannesburg Stock Exchange All Share Index (JSE ASI), francophone West Africa’s Bourse Régionale des Valeurs Mobilières Composite Index (BRVM CI) and the Nairobi Securities Exchange All Share Index (NSE ASI).

Once again, the financial sector index (GSE-FSI) underperformed the general market; closing the period under consideration with a YtD dip of 0.93 percent. This comes as technology and banking stocks accounted for 98.27 percent of the GH¢34.5million worth of stocks traded.

Offshore investor participation grew marginally, accounting for 87 percent of equity market trades compared to 86.98 percent for the same period in 2021.

Q1 blues

Commenting on the market’s performance since the turn of the year, a senior analyst with UMB stockbrokers, Kofi Bussia Kyei, said the development is not inconsistent with expectations for the first quarter of the year.

He however noted that if the trend for inflation – which closed January at 13.9 percent, an eight-month steady climb and its highest level in more than five years – as well as the similar developments with the value of local currency continues, we should expect an exodus toward the fixed income market.

“We have expected the first quarter to report very sluggish market activities and we expect it to pick up as the year moves. But looking at the trend for inflation, cedi-depreciation, it will have an impact on the market; and if this is not remedied soon, it could lead to a shift toward more investment in debt,” he explained.

He however expressed optimism that solid results from the banking sector, as well as MTN, will see sustained if not spectacular gains in the equities market.

His views are compatible with those expressed by Databank […]