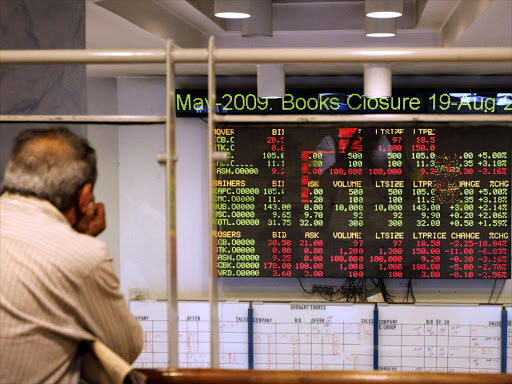

An investor looks at the digital board at the Nairobi Stock Exchange(NSE)/FILE Five top companies at the Nairobi Securities Exchange (NSE) increased market dominance to a year high of 75.4 percent, further worsening exposure risk for the Nairobi bourse.

The dominance rate is more than 100 basis points higher compared to 74.1 per cent recorded in the quarter ended March

The quarterly market soundness report released Tuesday by the Capital Market Authority shows Safaricom, East Africa Breweries Limited (EABL), KCB Group, Equity Bank and Co-op Bank now control Sh1.66 trillion of investors wealth out of Sh2.2 trillion.

This has made it difficult for investors to measure the true performance of the bourse due to the companies’ outsized influence on key market indicators.

Safaricom’s valuation alone was worth more than all the other listed firms combined, with its investors’ wealth of Sh1.2 trillion accounting for 56 per cent of the NSE’s market capitalisation.

The market dominance has been rising steadily up from 65 per cent five years ago as investors’ confidence in below the chart counters dwindle.

Experts have warned that the market concentration could likely plunge the bourse in case of high volatility on one of the major counters, insisting that dominance must be ironed for out in order to ascertain the true stability of the market.

Speaking while unveiling the Q2 2020 report, CMA Wyckliffe Shamiah the market concentration is a worry for the regulator, saying several initiatives are in place to correct the situation.

He however warned that this may not be achieved overnight considering the high trust those five major companies have earned from investors.

”We have employed various mechanisms to bring more firms to list at NSE as one of the ways to iron out market dominance. More listings mean the further spread of the risk,’’ Shamiah said.

In its bid to reduce the exposure risk leveled by the high market concentration by the top five companies at the bourse, CMA has developed a short-term strategy aimed at reviving the market from Covid-19 effects.A key initiative to be undertaken includes partnering with the Privatization Commission and policyholders in promoting privatization and divestitures of government stake in some companies as a measure aimed at diversifying the pool and sector of securities listed with the overall goal of diluting the concentration risk to sustainable levels that can be cushioned by the markThe Nairobi bourse witnessed much slower activities during the quarter under review, with the turnover ratio […]