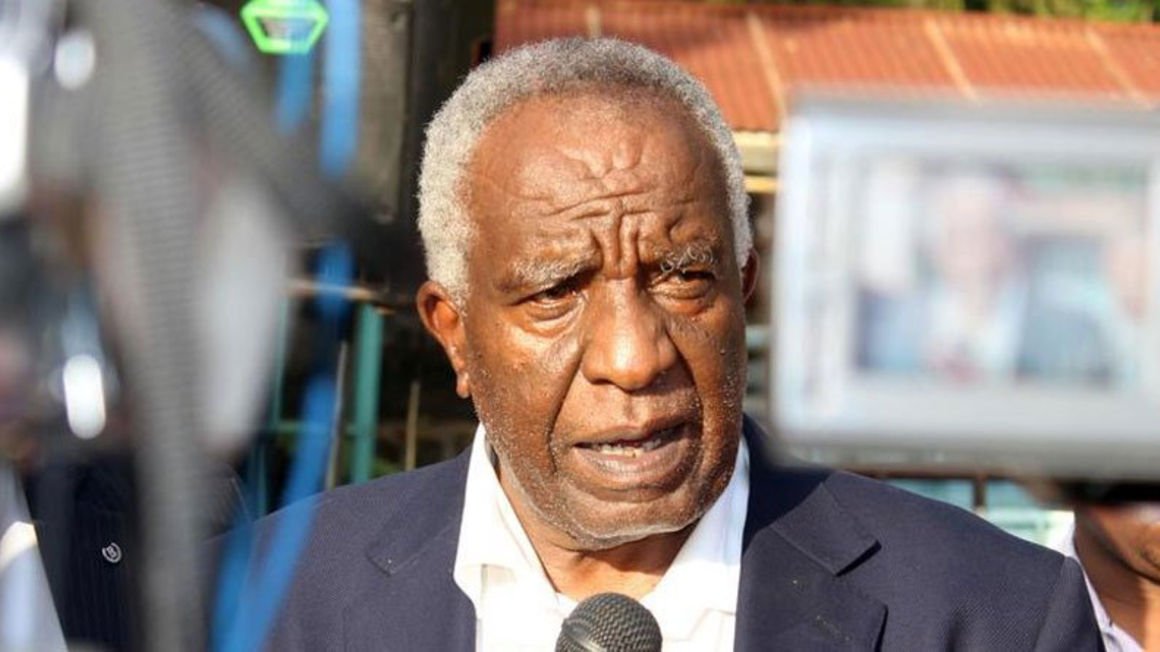

Mr Peter Munga. FILE PHOTO | NMG Billionaire businessman Peter Munga orchestrated a secretive purchase of 452.5 million shares of Britam Holdings from the government of Mauritius in a deal that left the island nation with a Sh3.9 billion loss, according to an inquiry report.

The Port Louis commission of inquiry, which investigated the transactions, established that the then Mauritius’ Minister of Financial Services, Good Governance and Institutional Reforms Roshi Bhadain helped the Kenyan businessman buy the shares for Sh7.1 billion in 2016.

This was despite the fact that there were rival higher bids of Sh11 billion each from South Africa’s insurance firm MMI Holdings and Barclays Bank (now Absa Group), which Mr Munga had earlier promised to match.

The Britam shares were seized by Mauritius in 2015 from its citizen Dawood Rawat, whose Sh71 billion ponzi scheme was exposed, putting pressure on the government to sell his assets in Kenya and other jurisdictions to compensate investors and policyholders.

After buying the shares, Mr Munga would later sell them in two tranches at undisclosed prices that are expected to have earned him billions of shillings in capital gains.

He first sold 104 million shares in 2017 in the open market and followed it up with the disposal of 348.5 million shares to Zurich-based multinational Swiss Re in 2018.

Mr Munga called the roundabout transactions a “Manowari Project”, according to the inquiry.

Manowari is a Swahili name for submarine and the authors of the report say it is a fitting description of the secretive nature of the transactions.

The sale of the shares to Mr Munga’s investment vehicle Plum LLP would not have been made public in Mauritius had it not been for a question asked by the Leader of the Opposition.

On May 3, 2016, Mr Bhadain casually told Parliament that the shares had been sold to Mr Munga.

The response prompted the formation of the inquiry after it emerged that the Kenyan businessman had bought the stocks at a cheaper price and the laid-down procedure for handling Mr Rawat’s assets was ignored.There were several meetings between Britam directors and Mauritian officials in Nairobi and Port Louis but the most consequential was a secret one between Mr Munga and Bhadain on Saturday, November 14, 2015.They were joined by officials of BDO, the accounting firm that had been appointed as special administrators of the Rawat assets.“This was the meeting that changed the course of history of this sale which would […]