•According to NSSF Managing Trustee, Anthony Omerikwa, the demand for NSSF services has gone beyond formally employed people to entrepreneurs.

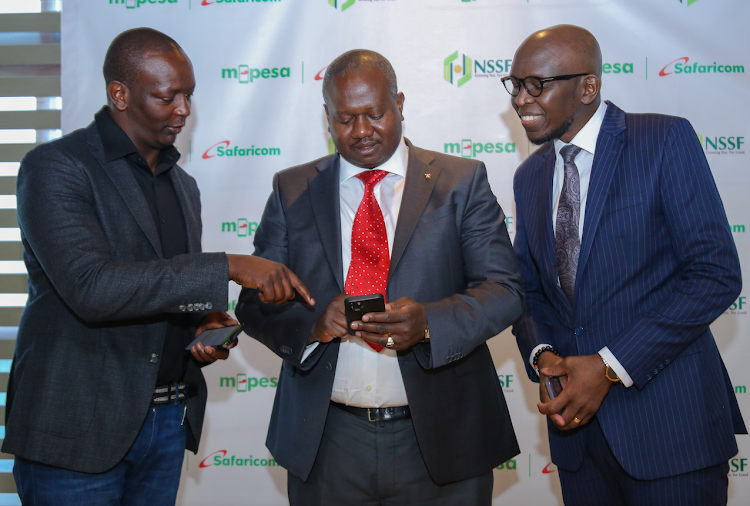

•Customers can register for NSSF membership, keep track of their contributions, top up and manage their NSSF account. Safaricom Chief Financial Services Officer Sitoyo Lopokoiyit, NSSF Managing Trustee Antony Omerikwa and Safaricom Chief Enterprise Business Officer Kris Senanu, during the launch of the NSSF mini app at the Safaricom HQ, Nairobi/HANDOUT The National Social Security Fund and Safaricom have partnered to provide various mobile app pension services.

Customers can register for NSSF membership, keep track of their contributions, top up and manage their NSSF account, and make Tenant Purchase Scheme (TPS) payments all within the M-Pesa app.

According to NSSF Managing Trustee, Anthony Omerikwa, the demand for NSSF services and the need to save for pension has gone beyond formally employed people to entrepreneurs, especially those running medium and small businesses.

"It has therefore become necessary to partner with organisations such as Safaricom to extend the reach of our services including though smartphones on the NSSF M-PESA Mini App,” Omerikwa said in a statement on Monday.

Customers can access the NSSF Mini-App through the “Discover” option on the M-Pesa super App.

As part of the launch, the first 1,000 NSSF members to make contributions through the NSSF M-Pesa Mini App will get an extra 10 per cent free topped up to their account.

“We continue to explore different ways to provide our customers with even more convenience and access to useful services by establishing key partnerships with organisations such as NSSF,"said Safaricom CEO Peter Ndegwa.

He said the NSSF mini App will go a long way in providing customers with an exceptional user experience, while providing them with the freedom to access services on their smartphones at any time through the M-Pesa super App.

The NSSF M-Pesa mini App comes on the back of the November 2019 launch of Haba Haba, a savings plan for business people in the jua kali sector.

Haba Haba gives members a chance to save a minimum of Sh25 a day, with the option of withdrawing 50 per cent of their contribution after consistently contributing for a minimum of five years.The M-Pesa Super App provides customers with a range of mini Apps that enables them to convenient access a variety of products and services from a single app on their smartphones, including SGR booking, airline tickets, bus tickets, shopping gift vouchers, insurance gas delivery, […]