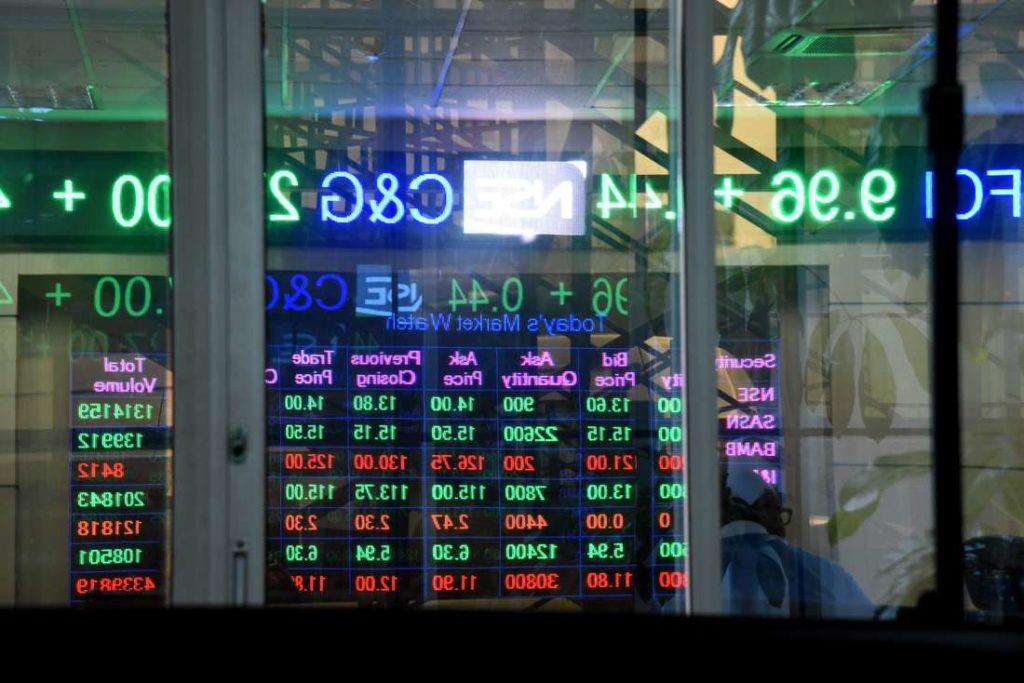

The fact that five companies listed on the Nairobi Securities Exchange (NSE) control almost 80 percent of the capital market is a big risk that should be addressed urgently.

Safaricom, East Africa Breweries Limited, Equity, Co-operative Bank and BAT Kenya counters see more trading activity in a day than most other stocks attract in months. Safaricom alone is worth more than all the other listed firms combined, with its valuation of Sh1.53 trillion accounting for 60.4 percent of the NSE’s market capitalisation.

Granted, any investor worth his salt will always put his or her money in stocks likely to give the highest — the reason the five counters are much sought-after.

It is, however, also true that the delisting of firms like KenolKobil and erosion in value of former blue chip stocks like Kenya Airways and Kenya Power have severely limited investor choice, pushing them to the five stocks.

This has created market distortion. The quintet’s continued meteoric performance in the midst of a pandemic that has pushed most listed firms into a financial hole gives the false impression of general market recovery. The Capital Markets Authority (CMA) has rightly flagged the dominance as a big risk. For instance, if Safaricom were to exit the market today, the ripple effects would be ruinous to many investors.

To correct the imbalance, the CMA has been pushing for fresh listings of high value firms. There is no shortage of such firms, both in the public and private sectors.

The regulator is working with market players including the Privatisation Commission, Kenya Private Sector Alliance, and Kenya Association of Manufacturers, in identifying potential issuers within the Kenyan market — both large cap and SMEs as a way of increasing diversity within the Kenyan market.

They, however, need the right incentives to go public. This puts the onus on the Treasury to introduce these incentives and ensure their speedy implementation.

The government should go a step further and reduce its shareholding from some of the listed companies. In so doing, it will open up the market for more retail investors.