Peter Skerritt is the founder of Peter Skerritt & Associates, a financial markets training company specialising in financial risk and derivatives.

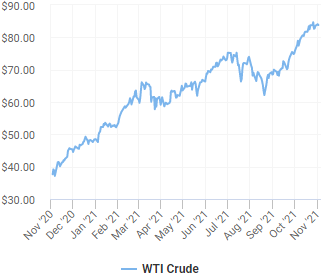

As the chart below shows, and cash-squeezed South African motorists know all too well, the oil price has more than doubled over the past 12 months, recently reaching highs not witnessed for several years.

While this is ostensibly good news for producers and commensurately bad news for consumers, the latest surge in prices presents challenges to both sides of the market, regarding their hedging strategies going forward.

The recently released 2021 Global Risk Management Survey by the international insurance group Aon ranks commodity price risk as the fourth most pressing concern for over 2,300 polled key risk decision-makers in 60 countries around the world, the highest since it was added to the list in 2009. Oil hedging has somewhat of a chequered history, and attempts by corporations to reduce their exposure to the wild gyrations characteristic of this market is generally regarded as a case study of what not to do, rather than one of sound risk management. Some commentators have even proposed a trading strategy, according to which one should buy oil when producers lock in selling prices and sell when large oil-consuming entities lock in buying prices!

Airlines, in particular, have been extremely adept at screwing up when it comes to making strategic decisions to limit their exposure to the price of jet fuel, which is obviously highly correlated to the price of crude. The well-publicised and substantial oil hedging losses of African carriers such as Air Mauritius, South African Airways and Kenya Airways are mirrored by the losses experienced by their international peers; for example, Delta Airlines admitted to $4-billion of losses on oil hedges in the several years up to 2016.

Producers too seem to have a knack for getting their knickers in a twist when it comes to deciding whether or not to lock in prices for future production. A report in July this year, by the consultancy firm IHS Markit, showed that almost a third of the 11 million barrels a day of US production was being sold at average hedged prices of just $55 a barrel, at a time when the market price was at a lofty $75. This equates to an opportunity loss of close to $30-billion for 2021 for these producers, based on the current price of $84. Many of these hedges were concluded […]