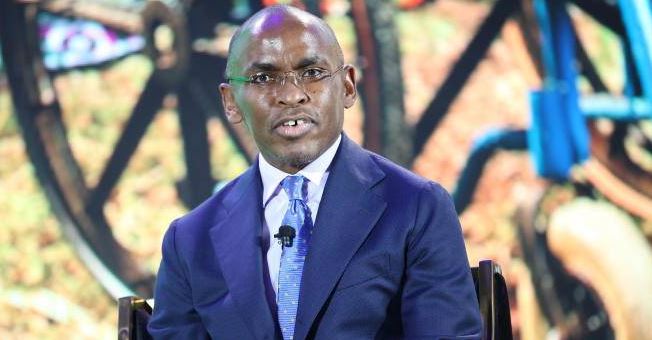

Safaricom Chief Executive Peter Ndegwa (PHOTO: Wilberfoce Okwiri) NAIROBI, KENYA: Safaricom shareholders will not go without dividends despite disruption and economic challenges witnessed last year following the outbreak of Covid-19 Pandemic.

The uncertainty over Covid-19 pandemic saw many companies especially in the banking sector withdraw dividend payout in a strategy to keep cash within.

Safaricom’s Board on Thursday said it has approved the payment of an interim dividend of Sh0.45 per ordinary share held amounting to Sh18.029 billion for the year ending March 31.

“This is in recognition of the company’s solid half year performance and to support our shareholders during these difficult economic times occasioned by the Covid-19 pandemic,” said Kathryne Maundu, Company Secretary in a notice.

“The interim dividend will be payable to shareholders as at the close of business on March 5 and will be paid on or about March 31.” Read More

The giant telecommunication company also made changes to its board tapping a seasoned investment banker Christopher Kirigua to replace Cabinet Secretary National Treasury Ukur Yatani.

It also appointed Winnie Ouko as an independent Non-Executive director in the board with effect from February 10.

Christopher Kirigua serves as the Director General of Public Private Partnership at the National Treasury. He was recently the co-chair of a strategic committee in the United Nations Global Investors for Sustainable Development.

His role at UN was to focus on widening long-term investments mainly in emerging markets.

Winnie Ouko on the other hand has over 25 year’s experience in finance, strategy and board level experience, serving corporates and non-profits in Africa, Europe and the US.

She is the founder and CEO of Lattice Consulting, a Kenyan-based boutique advisory firm.According to the company’s half-year results for the 2020 financial year, profit after tax stood at Sh33 billion, down from Sh35 billion recorded in a similar period last year, with M-Pesa standing out as the biggest driver for the decline in earnings. “The impact of our response to Covid-19 in zero-rating M-Pesa transactions weighed heavily on our performance for the first half with service revenue posting a decline of 4.8 per cent and earnings before tax down 10.5 per cent,” said Safaricom’s interim Chief Financial Officer Ilanna Darcy.Following the outbreak of Covid-19, Safaricom announced a waiver on all transactions below Sh1,000 to promote cashless transactions.The telco’s financial results indicate that M-Pesa revenue was down 14.5 per cent – from Sh41.9 billion in the first half of the last financial year […]