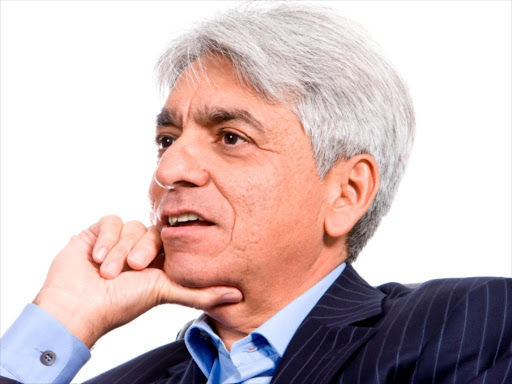

The audit report of the Nairobi Securities Exchange-listed communication and marketing firm, WPP Scan Group has exonerated founder Bharat Thakrar of alleged gross misconduct.

On Tuesday, the company’s board which on February 18 kicked out Thakrar and chief finance officer, Satyabrata Das pending investigation into their operations at the firm said it had found nothing incriminating on the two.

“Investigation did not identify items of a material nature that required adjustment to the results of the company or the Group for the year ended December 31, 2020, or to the balance sheets at that date,” the firm said in a delayed financial statement.

The board said that interrogations had taken longer than expected as a result of the extended scope of the audit by external auditors.

In April 2018, the then WPP CEO Martin Sorrell was forced to step down from the advertising company in the wake of an investigation into allegations of improper behavior and misuse of assets.

Sorrell who had led the British-based company for more than 30 years denied the allegations but supported the investigation, saying it was vital for the firm’s image and growth prospect.

A two-month investigation into the matter, however, found no evidence that company money was misused.

Immediately after the publication of the firm’s financial report which had been postponed three times to conclude the probe, Thakrar took to Twitter to claim his innocence.

”I founded Scangroup and have always had its best interest at heart,” the Nairobi-born entrepreneur who built the over Sh7 billion marketing giant said.

In 2017, he told Forbes that he would love to be remembered as one who made a difference in the Kenyan advertising industry.

The news of Thakrar innocence saw the company’s share at NSE gain trade as the biggest gainer for the day with 12.87 per cent to close the trading at Sh4.06.This, despite the reporting Sh1.7 billion loss for the year ended December 31, 2020, compared to a profit of Sh158.8 million the previous year.Total billings for the full year 2020 declined toSh6.34 billion from Sh9.28 billion reported in 2019 while operating and administrative expenses increased by Sh720 million Sh3.46 billion.Group revenue for the year under review declined by 22per cent to Sh2.239 billion from Sh2.872 billion reported in the same period in 2019.The company said that it made a net gain of Sh2.242 billion from the sale of its interest in Millward Brown East Africa Ltd, Millward Brown Nigeria Ltd, Millward Brown […]