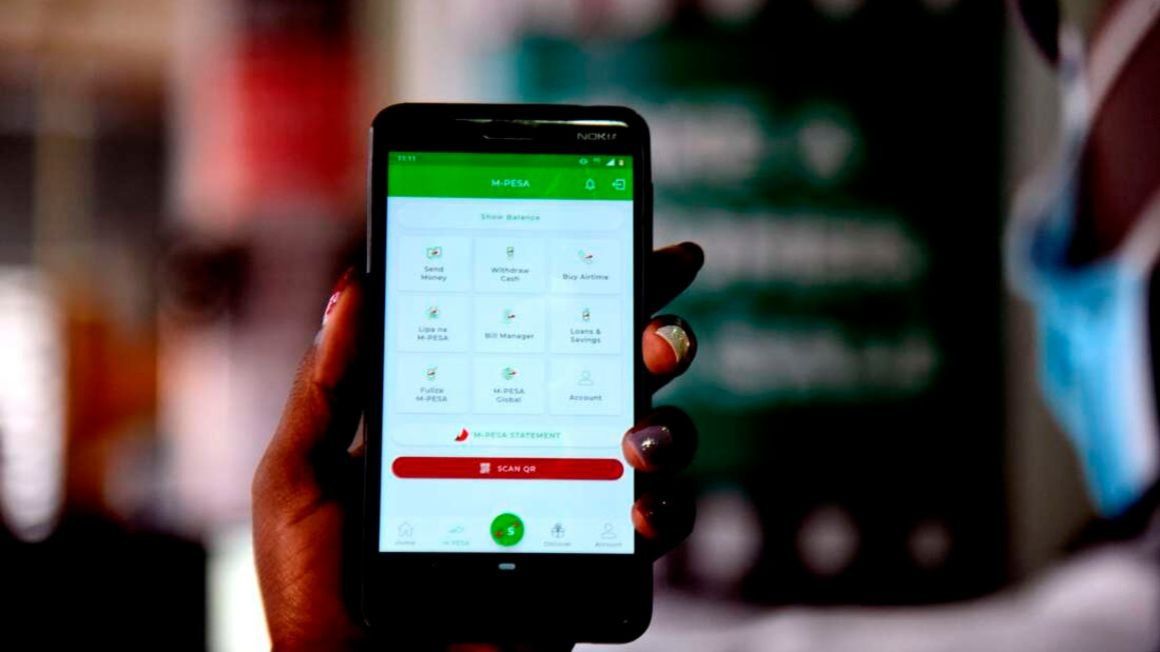

A user with the latest mySafaricom App. FILE PHOTO | NMG When Safaricom became the first company in the world to launch a mobile money transfer platform in March 2007, the service was only accessible to the telco’s customers through a SIM card.

The service, M-Pesa, grew rapidly as it made it relatively cheaper, faster, and convenient for individuals to send money and later pay for goods and services.

The wide adoption of M-Pesa was largely driven by the ubiquitous mobile telephony technology, with the country now having more handheld handsets than the population.

But the future of financial technology (fintech) is now seen to lie in developing internet-driven apps that are not necessarily tied to a particular telecoms operator.

The experience of South Africa’s Vodacom Group, previously a sister company of Safaricom and now the parent firm of the Kenyan telco with a 35 percent stake acquired in August 2017, signals the shifts in the digital financial services space.

Vodacom launched M-Pesa in South Africa in 2010, hoping to mirror the success Safaricom was witnessing with the service in the Kenyan market.

By this time, Safaricom’s M-Pesa users had grown to 10 million, marking the fastest customer acquisition seen in Kenya’s private sector.

For Vodacom, however, the mobile money service was a nonstarter. In June 2016, the multinational pulled the plug on M-Pesa, which had garnered a cumulative 76,000 active customers against its goal of signing up 10 million users in five years.

“Based on our revised projections and high levels of financial inclusion in South Africa, there is little prospect of the M-Pesa product achieving this in its current format in the mid-term,” said Vodacom’s chief executive Shameel Joosub at the time.

But Vodacom would make a second stab at fintech last year, this time partnering with China’s technology behemoth Ant Group to develop a “super-app” that puts a virtual marketplace in the hands of users.

The multinational says the adoption of its VodaPay service has exceeded its expectations, adding that the platform offers an insight into how M-Pesa could evolve in the future. One does not have to be a Vodacom subscriber to use the app.“In South Africa, the launch of our VodaPay super-app in October last year has exceeded our expectations by attracting 1.4 million downloads and 1.0 million registered users in its first three months,” the Johannesburg Stock Exchange-listed firm said in its third-quarter trading update.In its first three months, Safaricom’s M-Pesa customers had […]