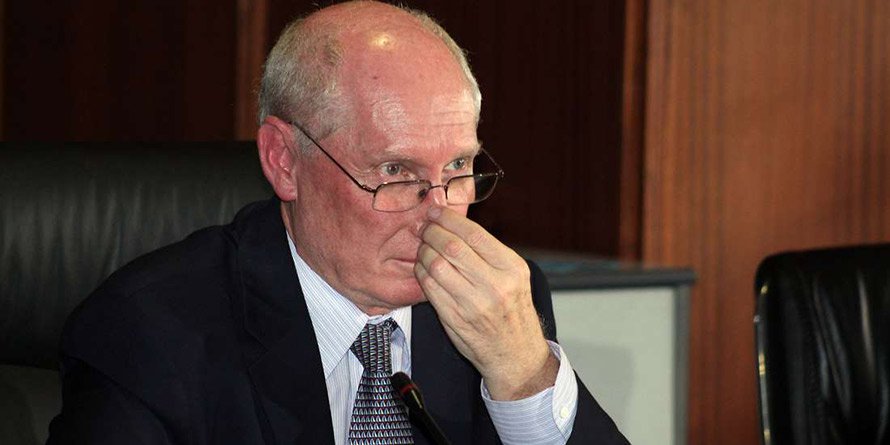

Unga Group managing director Nick Hutchinson. FILE PHOTO | NMG Unga Group’s #ticker:UNGA share at the Nairobi Securities Exchange (NSE) #ticker:NSE was back in suspension Tuesday, a day after a resumption of trading following a three-week hiatus that saw the stock drop 4.4 per cent to Sh37.50.

The NSE said the company sought an extra two days of suspension to conclude the transfer of shares bought by the US conglomerate Seaboard Corporation in its unsuccessful takeover bid for the firm.

The stock had been suspended since July 2 prior to Monday’s brief return to trading.

However, neither the NSE nor the Capital Markets Authority (CMA) issued a public notice announcing the return to trading on Monday, or the return to suspension yesterday. It resumes trading tomorrow.

Unga Group’s share price fell on Monday as the market reacted to the collapse of Seaboard’s Sh40 per share bid.

The miller’s stock had rallied from Sh29.25 on February 7 to highs of Sh43 in weeks following the Delaware-based conglomerate’s announcement that it would purchase an extra stake of up to 46.15 per cent in the company.

Unsuccessful bid

Seaboard announced last Friday that the takeover bid was unsuccessful, effectively removing the Sh40 per share floor that had supported Unga’s share price for about six months.

The multinational received acceptances amounting to 12.1 million shares or a 69.9 per cent stake, falling short of the minimum target of 75 per cent.

The buyout collapse has sent Unga, which has historically traded below its book value, back to normal market volatility.

Those who accepted Seaboard’s offer could still get paid at the offer price of Sh40 per share or an aggregate of Sh486 million if the multinational receives a waiver of the takeover’s conditions from the CMA.

The conglomerate signalled intention to take up the 12.1 million shares despite the failure to have Unga de-listed.In a circular to shareholders, the miller said the takeover conditions could be waived, allowing it to buy the tendered shares.“In the event of a waiver of a condition, the appropriate notices will be given to the CMA, the NSE and a public notice of such a waiver will be published in two English language daily newspapers with national circulation in Kenya within 24 hours of the waiver,” reads the circular.