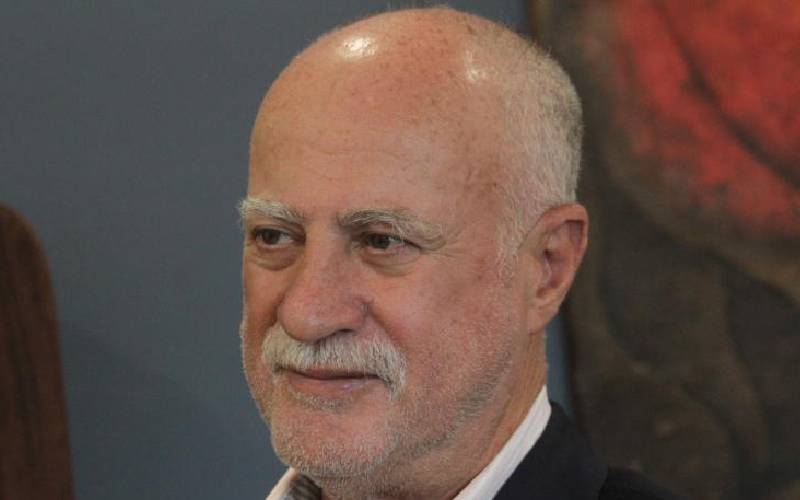

Safaricom Board Chairman Michael Joseph. The Central Bank of Kenya (CBK) is pushing telecommunications companies towards full interoperability – the ability of customers to pay anyone anywhere, with settlements happening in real-time.

While this is good news for customers, the revolutionary idea has Safaricom, Airtel Kenya and Telkom pulling in different directions.

Safaricom, whose mobile money service – M-Pesa – controls 99.9 per cent of the market, is open to the idea but says the rest of the players should learn to invest to make money, and not wait for freebies. “We are successful with M-Pesa, but why have we been successful? Why do we have 99 per cent market share?” poses Safaricom Chairman, Mr Michael Joseph , in an exclusive interview with Financial Standard.

“It didn’t happen because we got some favours from somebody. The reason why we are successful with M-Pesa is the massive investment we have made, mostly in distribution.”

That is the path he wants Airtel and Telkom Kenya to take to grow their Airtel Money and T-Kash products respectively.

The latest data from the Communications Authority of Kenya shows that M-Pesa had 261,150 agents compared to 22,802 and 8,349 for Airtel Money and T-Kash respectively as at the end of last December.

In terms of the value of transactions, CBK data shows M-Pesa commanded Sh2.206 trillion or 99.9 per cent of the total Sh2.208 trillion worth of transactions in 2021.

CBK recently rolled out the national payment strategy 2022-2025, with part of the focus being to build on the 2018 move that allowed sending of money across mobile money platforms.

The overall aim of full interoperability, CBK Governor Patrick Njoroge says, is to provide customers with seamless, secure and affordable functionality to send and receive money from any financial institution across the payments ecosystem.

Safaricom supports this. Mr Joseph says the telco is alive to the fact that to meet CBK’s goals, it needs to share some of its massive resources with competitors.

But this is a tough ask given the billions of shillings Safaricom has invested over time in building its current infrastructure.“To share our infrastructure and distribution agents just like that? Come on, you need to invest to make money,” said Mr Joseph. “I don’t think it is the right thing to force a company that has spent billions or perhaps trillions of money to create the business we have created and then to have to give it away because somebody […]