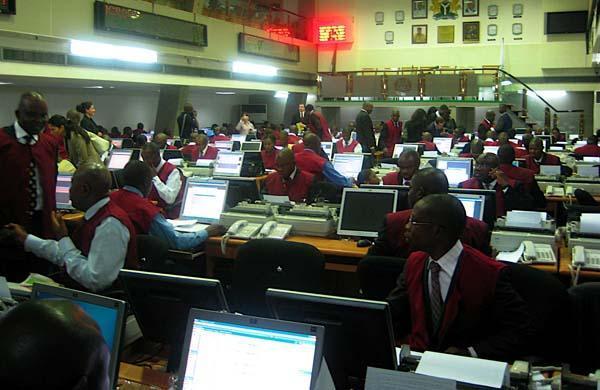

28 Firms Lose As Stock Market Declines Further

The nation’s stock market declined further on Tuesday as bearish sentiments persisted, making investors lose N4.8bn.

The market capitalisation of equities listed on the Nigerian Stock Exchange dropped from N10.954tn on Monday to N10.948tn on Tuesday while the year-to-date loss stood at -7.3 per cent.

On Tuesday, the stock market drew closer to a two-year low level of 25,780.02 basis points on April 21, 2017 and a one-year low level of 28,780.02bps as the All Share Index depreciated by 0.04 per cent to settle at 29,149.46 basis points on the back of sell-offs in Ecobank Transnational Incorporated, Dangote Cement Plc and Dangote Sugar Refinery Plc.

Activity level declined as volume and value traded fell by 17.7 per cent and 41.8 per cent to 374.026 million units and N3.057bn, respectively.

The top traded stocks by volume were Sterling Bank Plc (119.7 million units), Chams Plc (50.3 million units) and FBN Holdings Plc (44.6 million units) while the top traded stocks by value were Guaranty Trust Bank Plc (N788m), Zenith Bank Plc (N471.3m) and FBN Holdings Plc (N323.1m).

Performance across sectors was bearish as all indices closed on a negative note. The insurance index led losers, down by 1.8 per cent largely on the back of losses in NEM Insurance Plc.

The banking and oil and gas indices dipped by 0.5 per cent and 0.4 per cent, respectively, due to profit-taking in Zenith Bank, FBN Holdings and Oando Plc.

The consumer goods index fell by 0.2 per cent due to sell-offs in Nascon Allied Industries Plc and Dangote Sugar Refinery.

Major losses recorded in Dangote Cement dragged the industrial goods index down by 0.1 per cent.

Investor sentiment improved to 0.8x from the 0.4x recorded on Monday as 12 stocks advanced against 15 decliners.The top five losers were NEM Insurance, Ecobank, Livestock Feeds Plc, Niger Insurance Plc and Nascon Allied Industries, whose respective share prices shed 9.87 per cent, 6.67 per cent, 5.66 per cent, 4.76 per cent and 4.75 per cent.Analysts at Afrinvest Securities Limited said following the mild improvement in Tuesday’s trading session, relative to the prior session, they did not rule out the possibility of a positive performance in Wednesday’s trading session buoyed by the improving investor sentiment.“However, we advise investors to remain cautious while seeking for opportunities as we maintain our bearish outlook over the near term,” they added.