Nigeria’s macroeconomic performance recorded modest improvement in 2021 with gradual rebound in economic growth, declining inflation, steady corporate earnings and improved returns in the financial markets masking a turbulent currency management, persisting sense of insecurity, emergent COVID-19 threat and rising political risks. Deputy Group Business Editor, Taofik Salako reports.

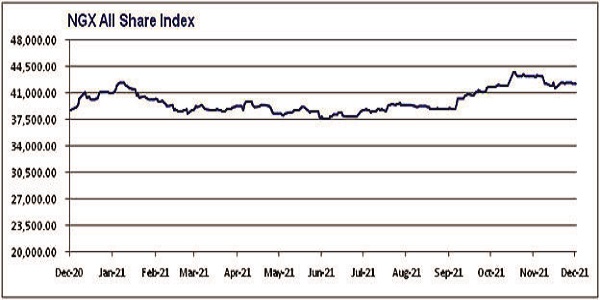

The Nigerian stock market is set for its second consecutive positive return with average price gain in 2021 standing now at 4.95 per cent, equivalent to more than N1 trillion in net capital gains. Yields at the fixed-income markets are also on the rise, supporting declining inflation to reverse, to some extent, losses suffered in the previous year. For eight consecutive months, inflation rate has decelerated closing at 15.4 per cent in November 2021 as against 18.2 per cent in March 2021.

The Nigerian economy has shown steady growth this year with the Gross Domestic Products (GDP) recording positive growths in the past three quarters. GDP rose by 0.5 per cent in the first quarter, leapt to five per cent and moderated to four per cent in the third quarter. All indications point to a stronger full-year GDP performance in 2021 with analysts’ estimate around three per cent, seven percentage points above its 2019 pre-recession growth of 2.3 per cent.

Buoyed by new issuances and improved crude oil inflows, the nation’s foreign exchange (forex) reserve will close 2021 on a positive note, despite the demand-push support for the naira. Nigeria’s forex reserve, at the latest count, stands at $40.6 billion as against $35.6 billion recorded at the beginning of the year. The naira, meanwhile, closed weekend at N415.10 per dollar at the official Investors and Exporters ( I & E) Window, representing a depreciation of more than five per cent on a rate of N394 per dollar recorded at the beginning of the year. At the parallel market, the naira now trades at $572 per dollar. The Federal Government issued a new $4 billion Eurobond and secured a $3.35 billion Special Drawing Rights (SDRs) at the International Monetary Fund (IMF). But the fourth quarter has seen an emergent COVID-19 threat with a surging rate of infection. Nigeria’s foremost medical training institution has reverted all academic activities to online, after alarming increase in infection rate at its hostel. The road to Nigeria’s 2023 national elections is unfolding with political risks, a major factor in an economy where government plays the dominant role.

Nigeria’s […]