Capital market analysts expect that equities would close positive this week as investors position ahead of the release of third (Q3) earnings by quoted companies.

Analysts at Cowry Assets Management Limited said that “In the new week, we expect the equities market index to close in positive territory as investors take position ahead of companies’ nine months financial results releases.”

Cordros Securities Limited stated that “We expect savvy investors to take advantage of the moderation in the share prices of bellwether stocks to make a re-entry in the week ahead. However, we expect intermittent profit-taking activities to persist as investors search for clues on the direction of yields in the fixed income (FI) market. Accordingly, we think the market will exhibit a choppy pattern. Overall, we advise investors to take positions in only fundamentally justified stocks as the unimpressive macro story remains a significant headwind for corporate earnings.”

Analysts at Afrinvest Limited noted that “In the coming week, we expect the momentum on the local bourse to remain elevated on improved investor sentiment.”

On market outlook for the week, the chief operating officer of InvestData Consulting Limited, Mr Ambrose Omordion said “We expect reversal as investors and traders take advantage of the market’s pullbacks to position, while many stocks are trading within their buy ranges, a situation expected to attract funds into the equity space, given the dividend yield capable of serving as a hedge against inflation.

“Also, institutional investors and others continue to digest recently release economic data ahead of the month and quarter-end, as well as the continued repositioning of portfolios for the year’s last quarter. Also, investors are still observing the interplay of forces in the FX market as the CBN gives a guideline for the new digital currency platform.

“The low volume suggests that institutional investors and others are still cautiously looking at the economic data and policy direction of the economic managers. It is noteworthy that oil price pullback in the international market; corporate actions, as well as the interim dividend possibilities, are around the corner.”

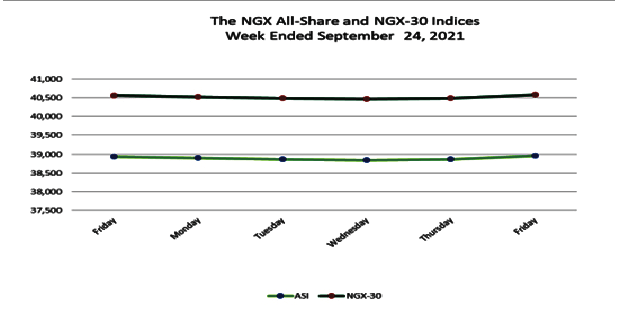

Last week, the Nigerian equities market extended its positive performance due to an improvement in investor sentiment. Hence, given the bullish momentum in the equities space, the NGX All-Share Index (ASI) rose week-on-week (w-o-w) by 0.05 per cent to close at 38,962.28 points. Similarly, market capitalisation rose N10 billion W-o-W to close at N20.300 trillion.

Sectoral performance was also positive. The NSE Insurance, NSE Oil & […]