The direction of the Nigeria equities market for this week seem uncertain, as capital market analysts are of the view that investors will focus on the outcome of the bond auction and the Monetary Policy Committee (MPC).

At a time when fresh headwinds have emerged over the health of the global economy and build-up in domestic inflationary pressures, the Monetary Policy Committee (MPC) is expected to hold its second meeting of the year on the March 21 and 22, 2022. Financial analysts expect the Committee to examine the global economy’s health within the context of withdrawal of monetary stimulus by global central banks amid the ongoing spat between Russia and Ukraine.

“On the domestic front, short-term inflation expectations will likely discomfort committee members, particularly given the pass-through impact of elevated global energy prices on headline inflation. In our opinion, the Committee will likely lean towards an accommodative monetary policy stance predicated on the need to fully realise gains from previous policy actions geared towards boosting economic recovery. We do not expect the Committee to hike interest rates in response to the hawkish monetary policy currently adopted by global central banks,” they said.

Analysts Optimism

In the week ahead, analysts at Cordros Securities Limited believe investors will focus on the outcome of the bond auction and the MPC meeting to gain further clarity on the movement of yields in the fixed income (FI) market.

“As a result, we envisage cautious buying actions from dividend-yield-seeking investors amid intermittent profit-taking activities. Notwithstanding, we reiterate the need for positioning in only fundamentally sound stocks as the weak macro environment remains a significant headwind for corporate earnings,” they said.

Cowry Assets Management expected a bullish run in the equities market amid further releases of year-end corporate financials and dividend declarations, saying that “However, we note that investors should trade cautiously by investing in stocks with sound fundamentals in order to enjoy favorable return on investment.”

Afrinvest Limited said: “this week, we expect to see extended profit-taking in the market due to the weak sentiment.” Also, GTI Securities noted that “The Nigerian equity market wrapped up transactions for last week bearish, as investors continue to trade cautiously in response to the increased economic risks, indicated by falling yield trends in the fixed income market and the tamed movement of the ASI. We expect these mixed sentiments to overshadow market activities this week.”

Last Week’s Trading Activities

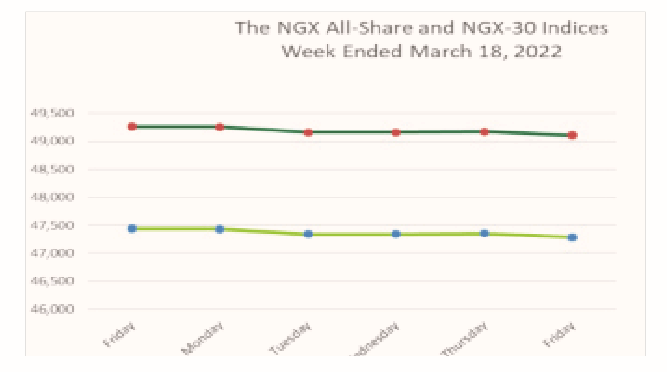

The domestic equities market […]