After rallying N7.76 trillion in net capital gains in two successive years, Nigerian equities are set for their third year with net capital gains of N602.02 billion at the weekend, bucking a generally negative opening trend in the global stock markets.

Benchmark indices at the stock market at the weekend showed average return of 2.66 per cent for the four-day opening trading week for the year, equivalent to net capital gains of N602.02 billion. The rally was driven by upsurge in open market orders for large and mid-cap stocks as companies begin preparations to release their audited reports and dividends for the 2021 business year.

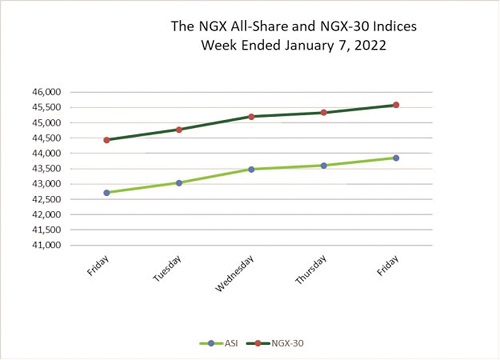

The benchmark index for the Nigerian stock market, the All Share Index (ASI) of the Nigerian Exchange (NGX) closed weekend at 43,854.42 points as against 42,716.44 points recorded at the beginning of the week. The ASI is a value-based common index that tracks all share prices at the NGX. It is regarded as the Nigerian sovereign equities index, a broad measure of the stock market.

Most analysts at the weekend said there were strong possibilities that share prices would continue to rise in the meantime citing the onset of the earnings season and increasing attractiveness of Nigerian equities to global investors.

Analysts at Afrinvest Securities said they expected “the positive performance to be sustained as more investors take position ahead of the dividend season”.

“In the new week, we expect the equities market to remain upbeat as investors continue to position in readiness for dividend distributions in the first quarter of 2022,” investment analysts at Cowry Asset Management stated.

Analysts at Cordros Capital also supported a bullish outlook for Nigerian equities.

“In the near term, we believe positioning for 2021 full year dividends will continue to support buying activities in the market even as institutional investors continue to search for clues on the direction of yields in the fixed income market.

“However, we advise investors to take positions in only fundamentally justified stocks as the weak macro environment remains a significant headwind for corporate earnings,” Cordros Capital stated.

The upwardly performance of the Nigerian stocks was contrary to the general decline at the global stock market. From America to Europe, Asia and Middle East, global stocks closed the first trading week of 2022 negative. In United States, the Dow Jones Industrial Average (DJIA) dropped by 0.3 per cent while the S & P 500 Index depreciated by 1.5 per cent. Europe’s broad index, […]