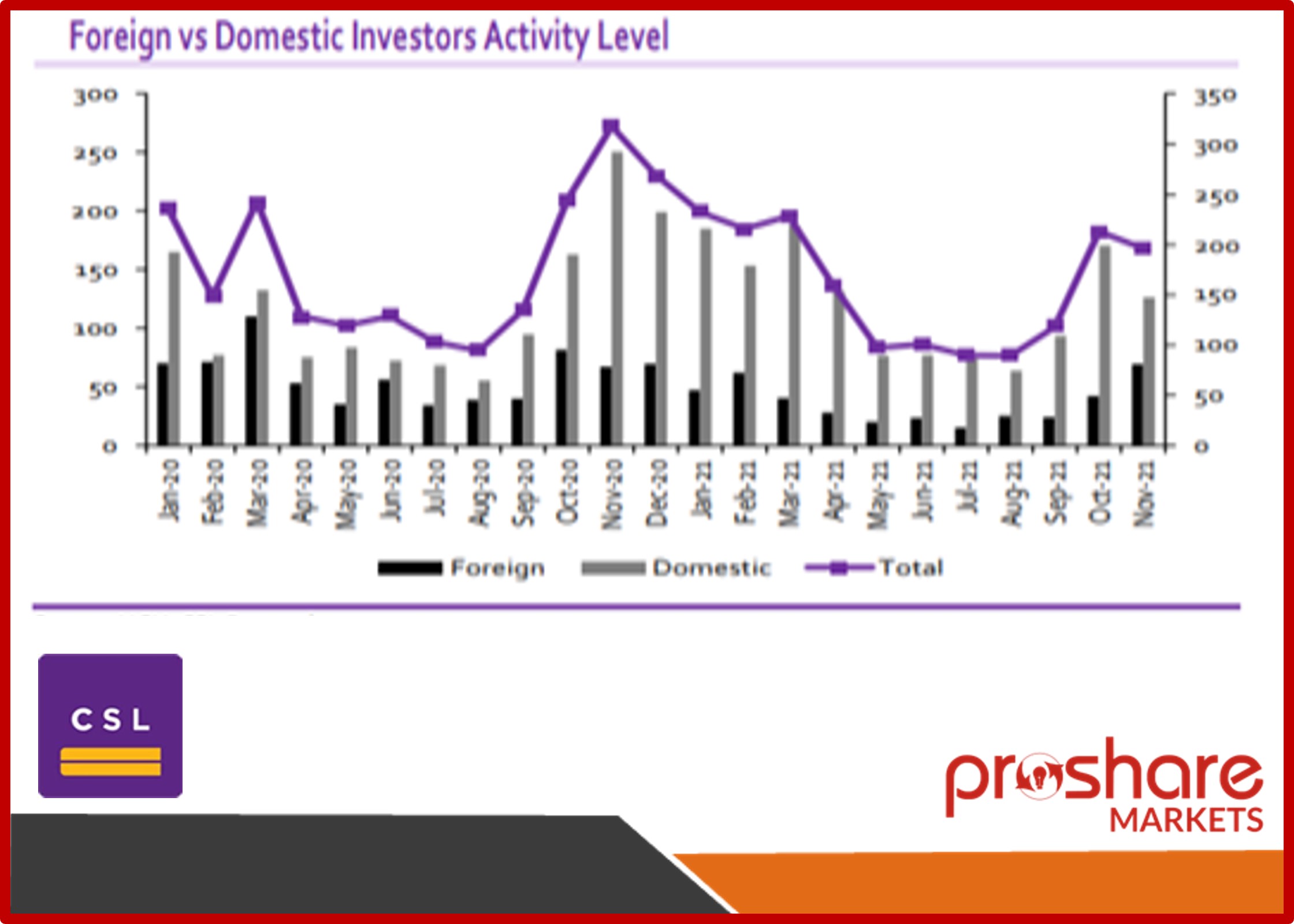

According to the recently released NGX Domestic & Foreign Investment report for November 2021, the total value traded on the local bourse, albeit still high, declined by 7.95% m/m to N196.1bn (US$472.5m) in November from N213.1bn (US$513.3m) in October. Despite the foreign investors’ increased activity level by 63.98% m/m to N69.6bn (US$167.6m), it was insufficient to compensate for the decline in participation level by the dominant domestic investors, down 25.82% m/m to N126.6bn (US$305.0m), resulting in a fall in total transaction value.

Meanwhile, the broad equity index, All Share Index (ASI), had returned 7.4% ytd as of the end of November from 4.4% in October, thanks to the buying activities that followed the news of the receipt of approval-in-principle (AIP) license by the two telecom giants (MTNN and Airtel Africa). Also, at the tail end of November, the announcement of the proposed acquisition of majority stake in Honeywell Flour Mills Plc (HFMP) by Flour Mills of Nigeria (FMN) drove activities around the target stock.

Notwithstanding the 27.82% m/m decrease in activity level, institutional investors still largely dominated transactions at the domestic front with N81.1bn (US$195.3m) in November. In the same vein, retail investors reduced participation on the local bourse, down 21.99% m/m to N45.5bn (US$109.6m) from N58.3bn (US$140.5m) in October. As regards foreign participation, it is noteworthy to highlight foreign investors have been net sellers of Nigerian equities for most of 2021, suggesting a low appetite for risky assets. The net outflow position grew to N3.3bn (US$8.0m) in November from N0.6bn (US$1.4m) in October, a fallout of higher foreign outflows of N36.4bn (US$87.8m) compared to inflows of N33.1bn (US$79.8m).

As 2021 closes the gates in the last 3 trading days, the local bourse is positioned for a second consecutive year of positive close. However, the market, just like in 2019, did not witness a Santa Claus rally in December, making it the second time in the last ten (10) years. Currently, the YTD gain has moderated to 4.9% from 7.4% in November due to the reversal of MTNN share price gains as investors who had bought at higher prices sold at the open market bringing the share price almost at par with the discounted offer price at the recently completed share sale. Beyond that, the sell-off of DANGCEM in the month also partly contributed. Proshare Nigeria Pvt. Ltd. Proshare Nigeria Pvt. Ltd. Related News

start=”1″> Domestic and Foreign Portfolio Participation in […]