By Dipo Olowookere

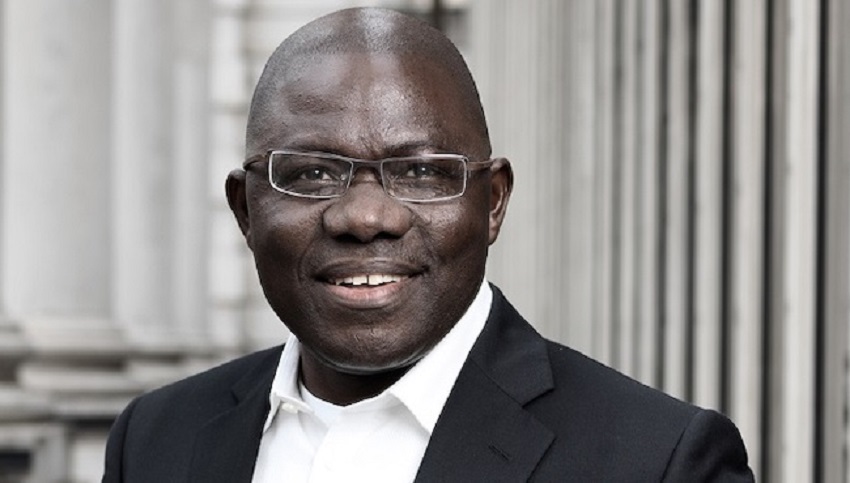

The Chairman of FBN Holdings Plc, Mr Remi Babalola, has exited his position barely nine months after he was appointed to occupy the seat.

The former Minister of State for Finance was appointed by the Central Bank of Nigeria (CBN) on April 29, 2021 , to head the board of directors of the organisation.

This followed the removal of Mr Oba Otudeko from the position by the apex bank after a boardroom crisis threatened the financial institution.

It is unclear why Mr Babalola has decided to resign from the position, though the financial services group is yet to formally announce the development.

The exit of the Chairman from the firm is coming a few days after it was confirmed that Mr Femi Otedola has made a significant investment in FBN Holdings with the acquisition of additional 200 million shares of the organisation, raising his stake to over 7 per cent.

It is not certain if this development will affect the share price of FBN Holdings at the Nigerian Exchange (NGX) Limited next week.

When the market closed for the week on Friday, the price of the company’s stock rose by 0.42 per cent or 5 kobo to sell for N12.00.

The equity value has been on a roller coaster lately with heavy transactions through cross deals as the battle for who controls the company between Mr Otedola and Mr Tunde Hassan-Odukale thickens.

The CBN has seen the silent tussle as a good development and has expressed happiness with this because according to the Governor of the apex bank, a few years ago, First Bank shares were not attractive to investors .

“Six years ago, as I said, because of an aggressive build-up of NPLs, the share price of First Bank was about N2. We took it up. Then, everybody was running away from the shares of First Bank.“We have cleaned the balance sheet now, people are seeing that the money-making machine, First Bank, is back on its feet. They are in the race for profitability. They are now competing for the shares of First Bank. As of the last time I checked over the weekend, the share price was more N11.“Why should I quarrel about that? “I am happy to see that they are competing for the shares. Of course, we all know that First Bank is so large that no single person can own it. In running the banks, they should see themselves as […]